Setting real estate goals is the first step in achieving financial freedom through real estate investing. Whether you’re just starting out or you’ve had some experience with real estate, having clear goals will help keep you focused.

It’s not uncommon for people to admire others who have successfully invested in real estate when asked why they want to invest. However, it’s important to avoid confirmation bias and impulse investments, as both new and experienced investors can make mistakes. Some experienced investors may even fall into the sunk cost trap, making it challenging to objectively assess an investment’s alignment with their goals.

Goal setting serves as the foundation of investing. Whether it’s retirement, funding a child’s education, acquiring a specific asset, or achieving financial independence, properly set goals will drive you to surpass them. These goals provide a sense of accomplishment when realized and allow you to evaluate your performance for improvement.

In this article, we will explore the types of goals you should have as a real estate investor, along with some examples of real estate goals. We will also discuss SMART goals and how to set SMART real estate investing goals. Let’s dive in.

10 REAL ESTATE GOALS AND OBJECTIVES FOR SUCCESS

Real estate goals vary widely, from modest to highly ambitious, as investors enter the real estate market for diverse reasons. Some seek to supplement their income, while others aim for a comfortable retirement.

Each investor’s purpose for investing influences their risk tolerance, investment amount, and financial objectives. Here are some key real estate goals and objectives that every investor should consider:

1. Set a Net Worth Goal

Every working individual should have a target net worth goal, which can be set based on age. For instance, by age 40, aim to have a net worth double your annual income. By age 50, target four times your annual income. Real estate investments, such as rental properties, can contribute significantly to growing your net worth over time. These investments offer benefits like tax deductions, appreciation, and rental income, potentially yielding substantial returns.

2. Set a Goal for Honing Your Deal Analysis Skill

Analyzing investment properties is a crucial skill for successful real estate investors. Make it a goal to assess a certain number of properties each week to develop proficiency in identifying profitable opportunities. Focus on metrics like Net Operating Income (NOI), Cap Rate, Cash on Cash Return, Annual Gross Rent Multiplier, and Annual Cash Flow to evaluate deals effectively. Consider using the Savvy Investor Calculator to assist you with this.

3. Create a Goal for Continual Real Estate Education

Learning in the real estate industry never stops. Regardless of your experience level, it’s vital to stay updated on industry developments. Utilize online resources, such as podcasts, news, blogs, and online courses, to enhance your knowledge and grow your real estate portfolio.

4. Map Out a Portfolio Building and Diversification Goal

Diversifying your real estate portfolio is essential to reduce risk and maximize growth potential. Consider diversification by property type (residential, industrial, commercial), location (district, city), or investment strategy. Develop a goal for portfolio expansion, specifying the types of properties you want to acquire and when to add them to your portfolio.

5. Set a Goal for Growing Your Network

Establish a goal to expand your real estate network by connecting with buyers, sellers, agents, attorneys, and property managers. Seek to broaden your network beyond real estate professionals by engaging with experts from various fields. Growing your network enhances your understanding of the market and provides creative insights for optimizing your investment strategy.

6. Set a Goal for Growing Your Team

As your real estate business grows, building an effective investment team becomes crucial. Define the roles and responsibilities of team members, including real estate agents, attorneys, mortgage brokers, insurance agents, accountants, contractors, and repair teams. Invest time and effort in building a strong, reliable team to support your investment endeavors.

7. Set a Goal for Investing in Yourself

Just as you invest in assets, investing in yourself is equally important. Commit to personal development by enrolling in courses, coaching, and one-on-one training to address specific business or personal challenges. Invest in improving your skills and well-being to achieve greater success in your real estate ventures.

8. Set a Goal for Working Less

Consider setting a goal to reduce your direct involvement in day-to-day business operations as your real estate portfolio expands. Explore options like hiring a property management company and virtual assistants to streamline tasks. Working less allows you to focus on strategic decisions and business growth.

9. Create a Goal to Optimize Your Investment Portfolio

Regularly assess your investment portfolio to ensure optimal management of your assets. Prioritize tasks such as preventive maintenance, proper tenant screening, and diversification to minimize risk and maximize profitability.

10. Set a Retirement Funding Goal

Plan for your retirement by saving a portion of your income in investment accounts. Regardless of your real estate investment strategy, ensure it generates sufficient returns to support your retirement goals.

WHAT DOES SMART GOALS MEAN?

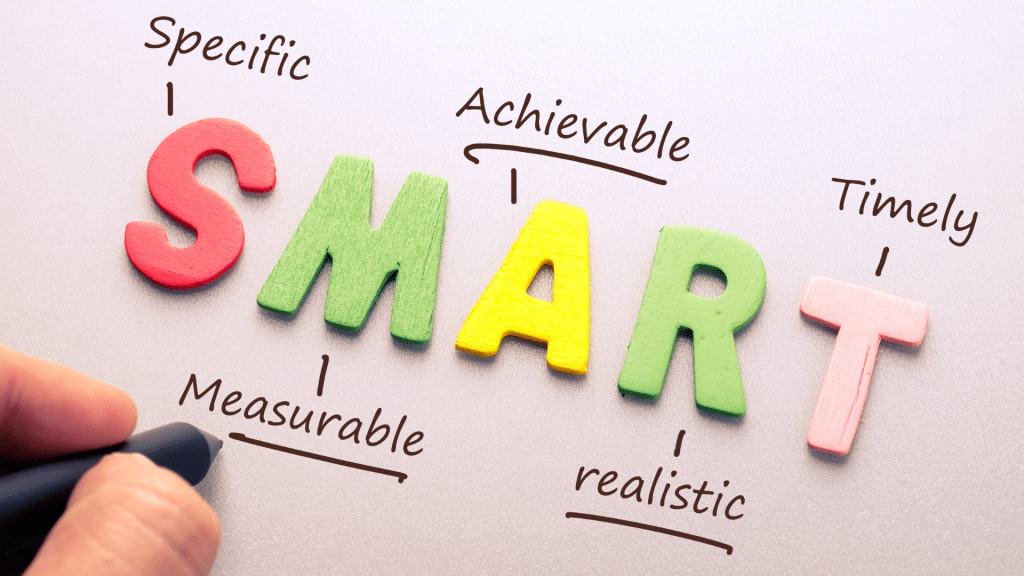

SMART is an acronym for effective goal setting, popularized by George T. Doran in 1981. SMART goals are:

- Specific: Clearly defined with expected outcomes, responsible parties, and necessary steps.

- Measurable: Quantifiable with criteria to determine achievement.

- Attainable: Achievable with available resources.

- Relevant: Relevant to your real estate investment needs.

- Time-bound: Set with a specific completion date.

An example of a SMART real estate goal would be “to increase monthly rental income by 30% from $10,000 to $13,000 within six months.”

HOW TO SET REAL ESTATE GOALS THAT ARE REALISTIC

To set realistic real estate goals, follow these steps:

- Look Inwards: Carefully consider your desires and motivations.

- Evaluate Current Cash Flow: Understand your current financial situation.

- Create a Vision Board: Visualize your aspirations and goals.

- Track Your Results: Monitor your progress regularly.

Conclusion

In conclusion, setting SMART real estate goals is essential for long-term success in the industry. Clear, realistic, and time-bound goals keep you focused and prevent burnout. Remember that proper goal-setting is just the beginning; you must also develop a plan and allocate resources to achieve your goals effectively.