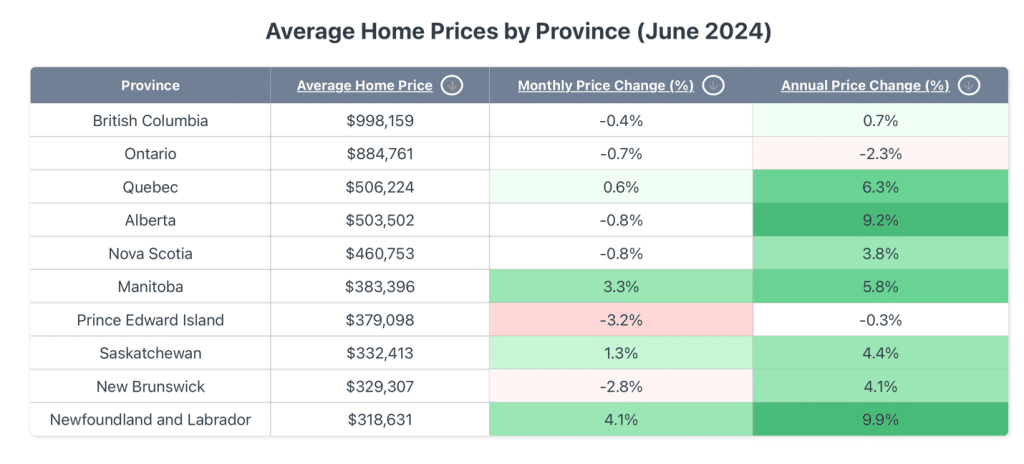

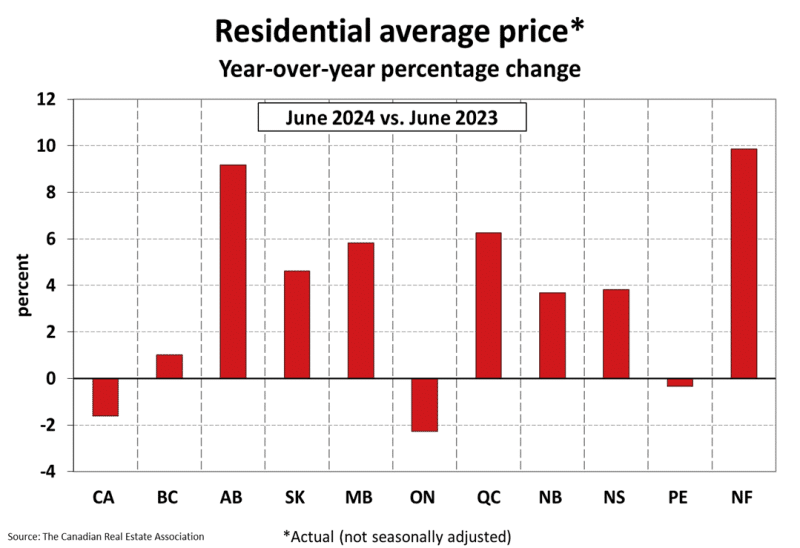

Canada’s housing market is seeing some mixed price movements in June 2024. The overall market appears to be cooling off, with the national average home price and benchmark price slightly declining compared to the previous month and year. However, certain regions are still experiencing strong positive annual growth, with some four provinces breaking all-time benchmark price records this month, indicating a diverse and dynamic market landscape.

In June 2024, the national benchmark home price, which measures the price of a “typical” home, was $730,600, a 0.4% monthly decrease and down 3.9% year-over-year. The average home price in Canada stood at $696,179, reflecting a 0.4% decline from the previous month and a 1.6% decrease from the previous year.

Canada Housing Market Insights for June 2024

Nationally, home sales reached 38,916 in June 2024, a seasonally adjusted 3.7% increase from the previous month and a 3.3% drop from the previous year. New listings were up 1.5% month-over-month, while active listings were up 26% year-over-year.

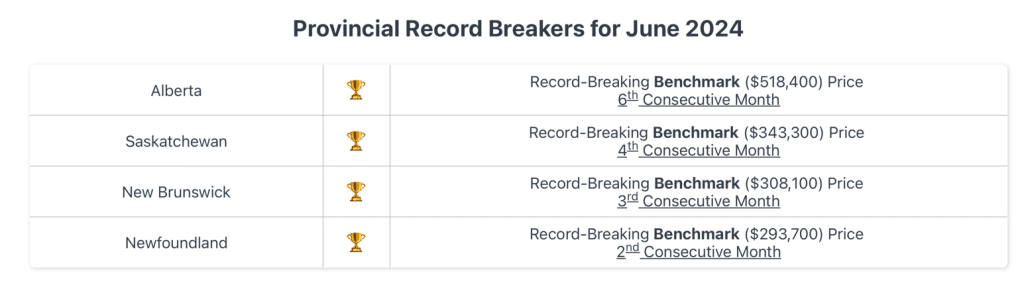

Provincial Record Breakers for June 2024

Alberta has seen its sixth consecutive month of record-breaking benchmark prices, reaching $518,400 in June 2024. This marks a significant milestone for the province, reflecting strong buyer confidence and sustained demand.

New Brunswick has also demonstrated strong price performance, shattering records for benchmark home prices. The benchmark price hit $308,100, a record high for the third straight month. This figure indicates a robust market with increasing property values.

Saskatchewan and Newfoundland round out the list of record breakers with a benchmark price in Saskatchewan of $343,300, breaking its record for the fourth month in a row, and Newfoundland’s benchmark price at $293,700, a record breaker for the second month in a row.

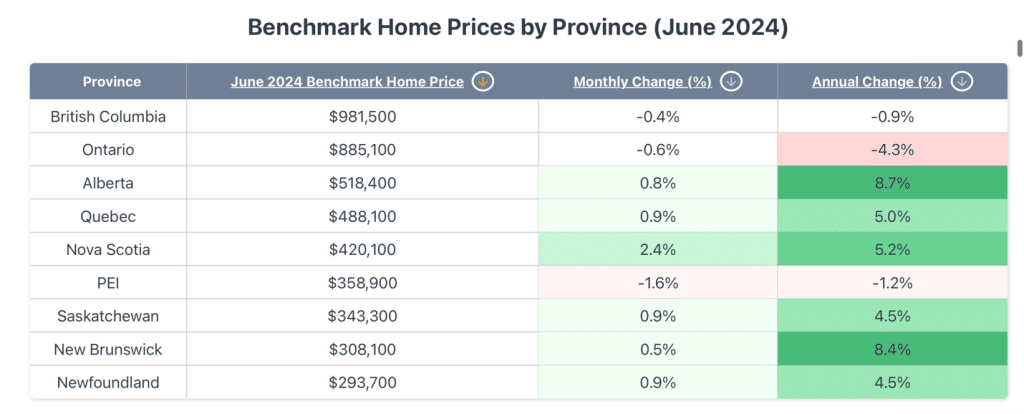

Benchmark Home Prices by Province (June 2024)

Benchmark Prices Across Canada

For June 2024, except for Ontario, BC, and PEI, the annual benchmark price change was mainly positive across the board. British Columbia continues to command the highest benchmark home price at $981,500, with a modest annual decrease of 0.9%. Alberta and New Brunswick both saw significant annual gains in their benchmark home prices, up 9% and 8%, respectively, with them both breaking all-time highs. Saskatchewan and Newfoundland also broke through their record highs in June 2024.

Ontario experienced the largest year-over-year decline in benchmark home prices, down 4.3% year-over-year. However, the national benchmark home price also dipped 3.9% year-over-year despite the wave of green brought about by the growth in prices in other provinces.

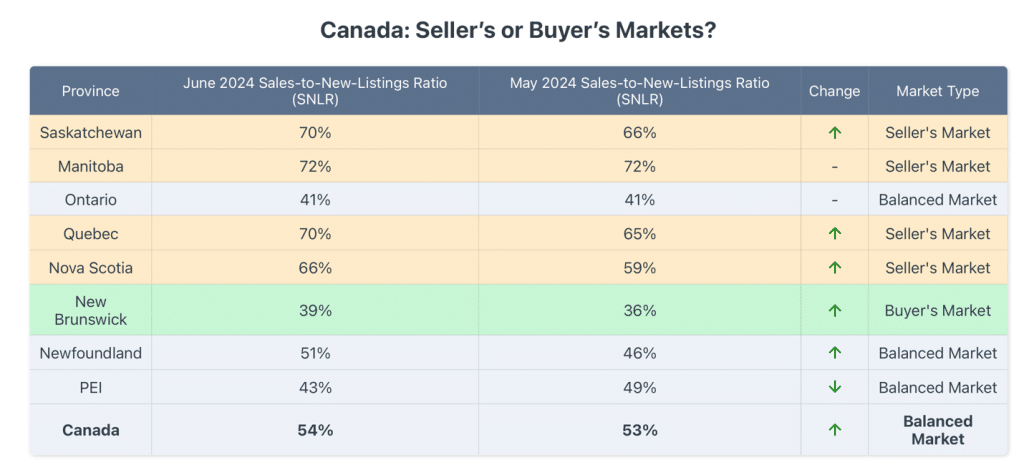

Canada Housing Market: Seller’s or Buyer’s Markets?

Sales To New Listings Ratio (SNLR)

For the month of June 2024, Canada’s sales-to-new-listings ratio (SNLR) remained steady at 54%, maintaining its status as a balanced market. This indicates that, on the national level, the equilibrium between supply and demand allows sellers to receive reasonable offers while providing buyers with adequate choices.

The majority of Canada’s provincial housing markets exhibit seller’s market conditions, indicating that demand remains high relative to supply. Saskatchewan and Quebec remain in seller’s market territory, with both of their SNLRs rising to 70%. Manitoba had no change in its SNLR compared to last month, remaining at 72%, reflecting increased pressure on buyers facing fewer options. Nova Scotia flipped into a seller’s market with an SNLR of 66%, up from 59% in May 2024.

Ontario remained in a balanced market with an SNLR of 41%, although just at the margins of a buyer’s market. PEI and Newfoundland are also balanced markets this month. New Brunswick is a buyer’s market, with its SNLR at 39%, suggesting that buyers have more negotiation power due to excess listings over sales. That’s despite New Brunswick’s benchmark price reaching an all-time high in June 2024.

The national SNLR maintained its value at 54%, up from 53% in May 2024. A stable SNLR at this level signifies a balanced market where demand and supply are evenly matched. An SNLR above 60% suggests a seller’s market, characterized by limited buyer options and higher competitiveness, while an SNLR below 40% signals a buyer’s market, indicating plentiful listings and increased buyer leverage.

Canada Housing Market: Regional Analysis

Ontario

Ontario’s housing market slightly declined in June 2024, with an average home price of $884,761, a 0.7% decrease from the previous month and a 2.3% drop from the previous year. The province recorded 16,060 sales in June 2024, down 15.1% year-over-year.

The average home sold price in the GTA was $1,162,167 in June 2024, representing a decrease of 1.7% year over year and 0.3% month-over-month. Meanwhile, the GTA’s benchmark home price is down 0.6% month over month to $1,110,600.

GTA home sales are down 16.9% year-over-year, with 6,213 transactions in June 2024. That’s a larger drop than the province-wide decrease of 15.1% year-over-year. The GTA’s SNLR was 35% in buyer’s market territory, compared to the province’s 41%, which signifies a balanced market. There were 61,524 active listings in Ontario’s housing market, the highest for the month of June in over five years.

British Columbia

British Columbia’s housing market remains somewhat steady, with an average home price of $998,159. Despite a 0.4% month-over-month decline, there was a year-over-year increase of 1.0%. The province saw 7,082 sales in June 2024, marking a 12.3% decrease from the previous month and a 19.0% decline from the previous year.

Greater Vancouver’s average home price for June 2024 was $1,349,985, up 6.2% year-over-year. This makes Vancouver the most expensive major city in Canada to buy a home.

Quebec

Quebec had an average home price of $506,224, up 0.6% from the previous month and a 6.3% increase from the previous year. That’s the highest that Quebec’s average home price has been in over two years since May 2022. The province saw 7,762 sales, down 14.7% from the previous month and a 5.6% rise from the previous year.

The Montreal housing market saw prices rise 5.4% annually to an average price of $614,972 for June 2024. Quebec City’s average home price of $412,016 has risen by 8.8% annually, outperforming Montreal and the provincial average. Meanwhile, Quebec City’s benchmark home price broke an all-time record this month in June 2024.

Atlantic Canada

Nova Scotia

Nova Scotia’s housing market remained steady, with an average home price of $460,753, a 0.8% decrease from the previous month and a 3.8% increase from the previous year. The province recorded 1,150 sales, a 4.6% decrease from the previous month and a 6.4% decline from the previous year.

New Brunswick

New Brunswick’s average home price was $329,307 in June 2024, a 2.8% decrease from the previous month’s record-breaking price and a 4.1% rise from the previous year. The province recorded 999 sales, a 2.1% increase from the previous month.

New Brunswick’s major cities are seeing mixed price movements, with Fredericton’s average home price dipping 7.3% month-over-month to $334,512, Moncton’s average home price rising 2.0% month-over-month to $377,693, and Saint John’s average home price decreasing 2.4% month-over-month to $332,373.

Prince Edward Island

Prince Edward Island’s average home price was $379,098, a 3.2% decrease from the previous month and a 0.3% decline from the previous year. The province recorded 161 sales, a 22.2% decrease from the previous month and a 22.2% decrease from the previous year.

Newfoundland and Labrador

Newfoundland and Labrador’s housing market showed strong growth, with an average home price of $318,631, a 4.1% increase from the previous month and a 9.9% rise from the previous year, the highest year-over-year growth among Canada’s provinces this month. The province recorded 489 sales, a 2.7% increase from the previous month but a 13% decrease from the previous year.

The Prairies

Saskatchewan

Saskatchewan’s housing market is on an upward trajectory. The average home price is $332,413, a 1.3% increase from the previous month and a 4.4% rise from the previous year. That’s the highest it has been since July 2022. The province recorded 1,675 sales in June 2024, a 1.0% decrease from the previous year. Saskatchewan broke an all-time price record for the fourth month in a row in June 2024, with its benchmark home price climbing to $343,300.

Saskatoon’s average home price of $393,048 in June 2024 is up 3.4% year-over-year, while Regina’s average home price of $325,153 is up 2.4% year-over-year.

Alberta

Alberta’s benchmark home price has climbed to a record high for the sixth month in a row, reaching $518,400. That’s up 8.7% year-over-year. Alberta’s average home price of $503,502 has slightly declined, down 0.8% monthly while remaining 9.2% higher yearly. Meanwhile, looking at Alberta’s major cities, home prices in Calgary are up 12.9% year-over-year to a record-high of $623,245, while Edmonton home prices had a 6.5% annual increase to $438,973.

Manitoba

Manitoba’s average home price was $383,396 in June 2024, a 3.3% month-over-month increase and a 5.8% year-over-year increase. The province recorded 1,684 sales, a 3.9% decline from the previous year.