The rental market in Canada has seen a major shift, and if you’re investing in real estate, it’s time to pay attention. According to the latest National Rent Report from Rentals.ca, the average asking rent in Canada fell to $2,109 in December 2024. That’s a 3.2% drop from last year, making it the first annual decline in rents since 2020. After years of relentless price hikes, this shift marks a turning point in the market.

For investors, this means rethinking strategies and understanding the forces behind these numbers. Let’s break down what’s happening and what it means for you.

A Market Cooling After Rapid Growth

Over the past five years, rents climbed by 16.8%, with annual increases averaging 3.15%. However, the last few months of 2024 saw a different trend, with rents declining 3.8% between September and December, per Rentals.ca. This reversal is the result of several factors:

- Increased rental supply – More purpose-built rental properties have entered the market, increasing competition.

- Economic uncertainty – High inflation and interest rates have impacted renters’ ability to afford high-priced units.

- Changes in demand – Renters are shifting preferences, with many opting for more affordable, smaller units.

If you’re in the real estate game, this cooling period isn’t a red flag—it’s a signal to adjust your approach.

Which Property Types Were Affected the Most?

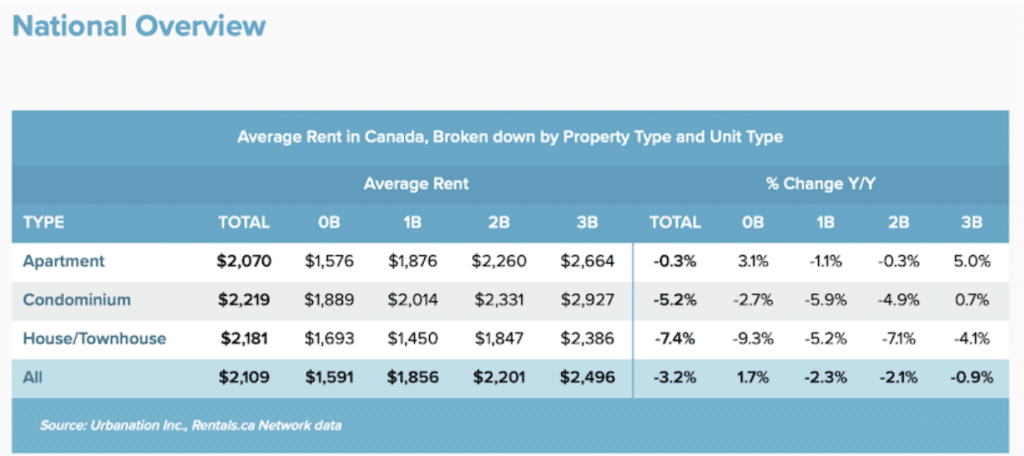

Not all rentals were hit equally by this decline, according to Rentals.ca’s report.

Single-Family Homes & Townhouses: The Biggest Decline

Single-family rentals and townhouses saw the sharpest drop, with average rents falling by 7.4% year-over-year to $2,181. Families looking to rent these properties are likely facing affordability issues, pushing them toward smaller or shared living spaces.

Condo Rentals: Prices Also Dropping

The condo market also saw rents fall, down 5.2% to an average of $2,219. With many new condos hitting the market, landlords are competing for tenants, keeping prices in check.

Purpose-Built Rentals: Holding Strong

Unlike other property types, purpose-built rentals were relatively stable, dropping only 0.3% to $2,070. This resilience is notable, especially considering that in 2023, this segment saw a 12.8% rent increase.

For investors, this data suggests that while single-family homes and condos may experience further fluctuations, purpose-built rentals remain a safer bet for long-term stability.

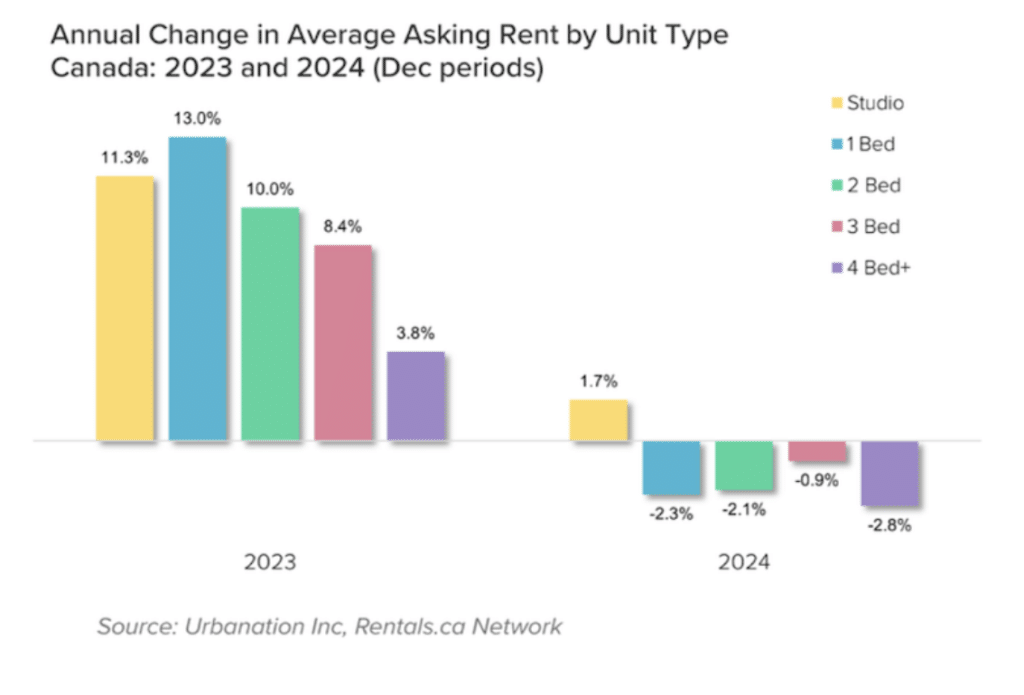

Unit Size Trends: Small is In

Breaking it down by unit size, Rentals.ca’s report reveals another key trend:

- Studio apartments saw the only rent increase, rising 1.7% to an average of $1,591. Budget-conscious renters, especially younger professionals, are opting for smaller spaces.

- Larger units, particularly four-bedroom rentals, saw a 2.8% decline, with average rents dropping to $2,946. Affordability concerns are driving renters away from high-priced, large units.

If you’re investing, these trends indicate that smaller, more affordable units are becoming increasingly attractive to renters.

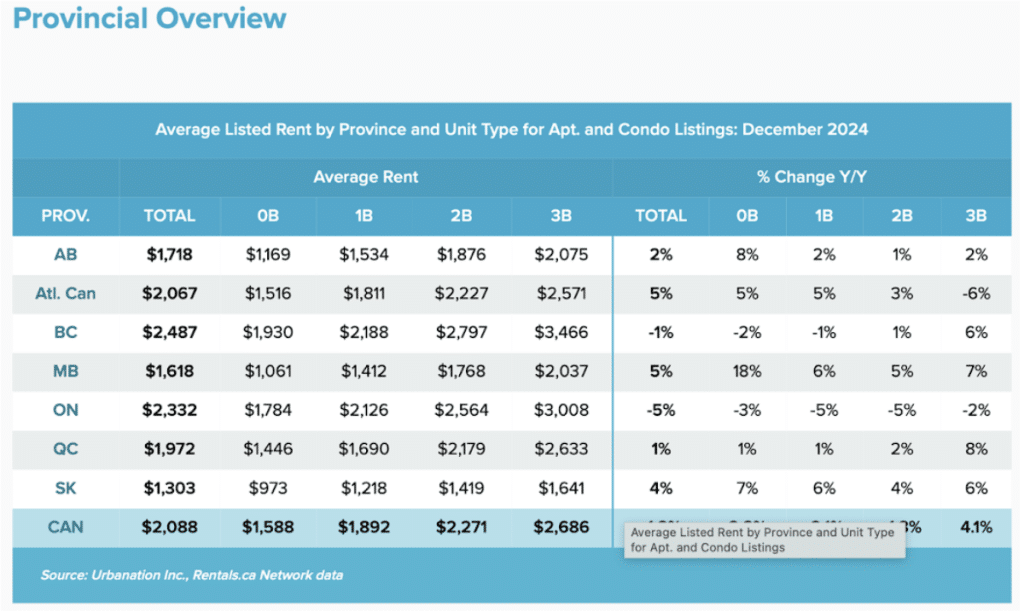

Regional Market Insights: Where the Money Is

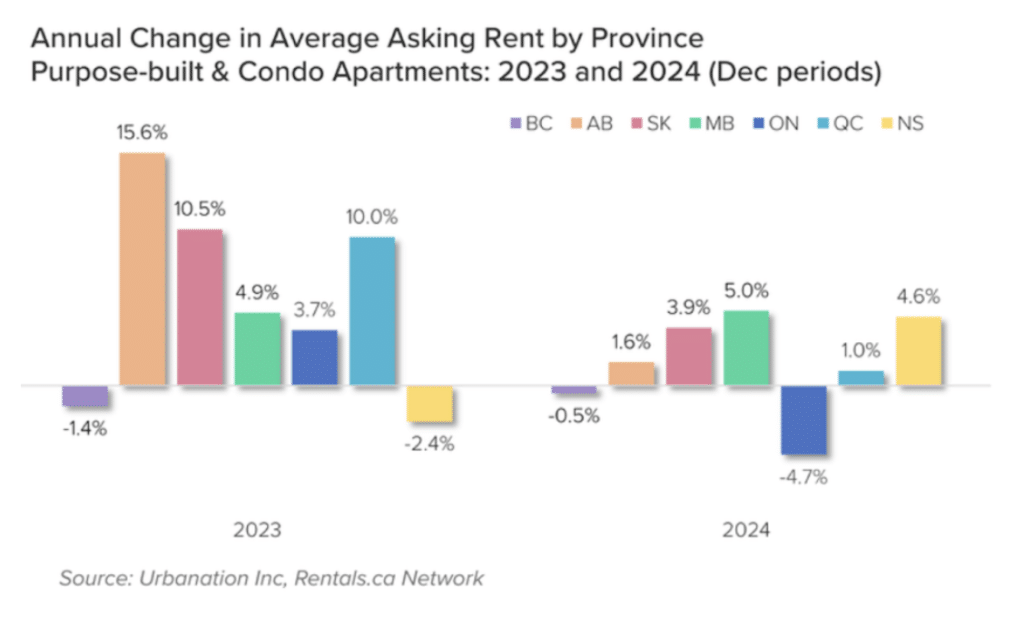

Rent Decreases Were Focused in Ontario Last Year

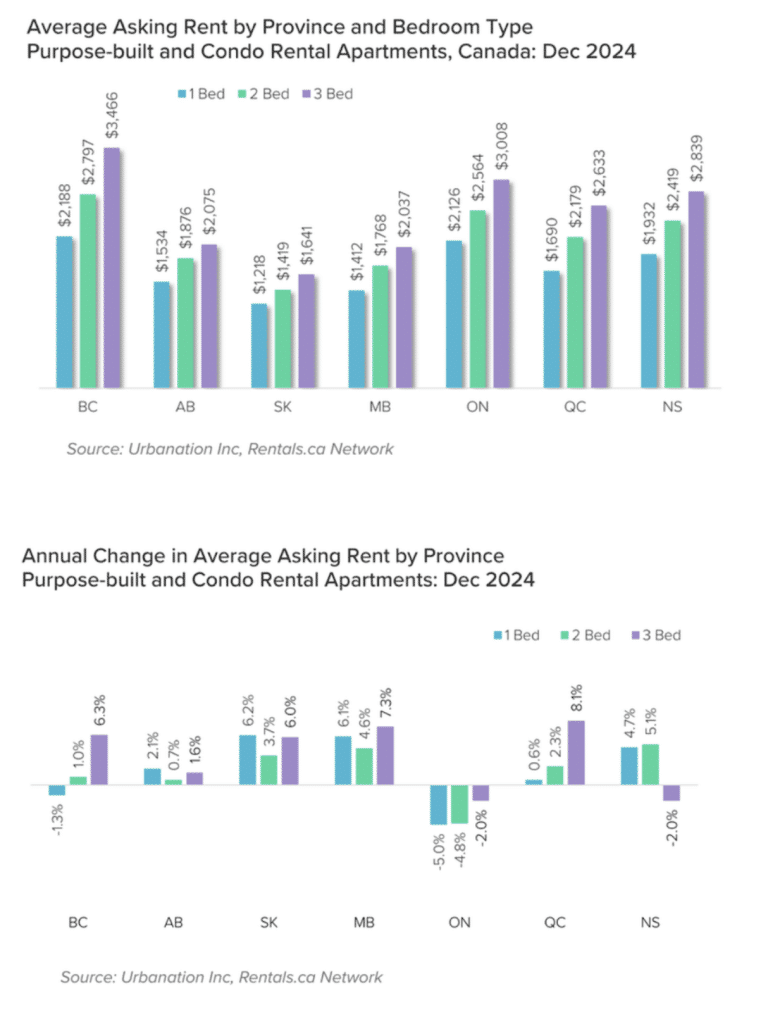

The decline in rents last year was mainly concentrated in Ontario, where average asking rents for apartments fell 4.7% to $2,332. This followed a 3.7% increase in apartment rents in Ontario during 2023. In B.C., asking rents for apartments ended 2024 down slightly from a year ago (-0.5%) to an average of $2,487. This marked the second year in a row that apartment rents decreased in B.C. following a 1.4% decline in 2023. Despite these decreases, B.C. and Ontario remained the provinces with the highest average rents in Canada.

Manitoba led all provinces in 2024 with a 5.0% annual increase in rents to an average of $1,618, which was consistent with the 4.9% increase in rents for the province in 2023. Rent increases decelerated the most in Alberta last year, where rent growth slowed from 15.6% in 2023 to 1.6% in 2024, with average rents reaching $1,718 in December.

Asking rents for apartments declined over the past year across all unit types in Ontario, led by a 5.0% decrease in one-bedroom rents to an average of $2,126 and a 4.8% decrease in two-bedroom rents to an average of $2,564.

In B.C., annual rent declines for apartments were limited to studios (-2.3% to $1,930) and one-bedrooms (-1.3% to $2,188), while three-bedroom rents rose 6.3% to an average of $3,466. Notably, high annual rent growth for three-bedroom apartments was also recorded in Saskatchewan (+6.0% to $1,641), Manitoba (+7.3% to $2,037), and Quebec (+8.1% to $2,633).

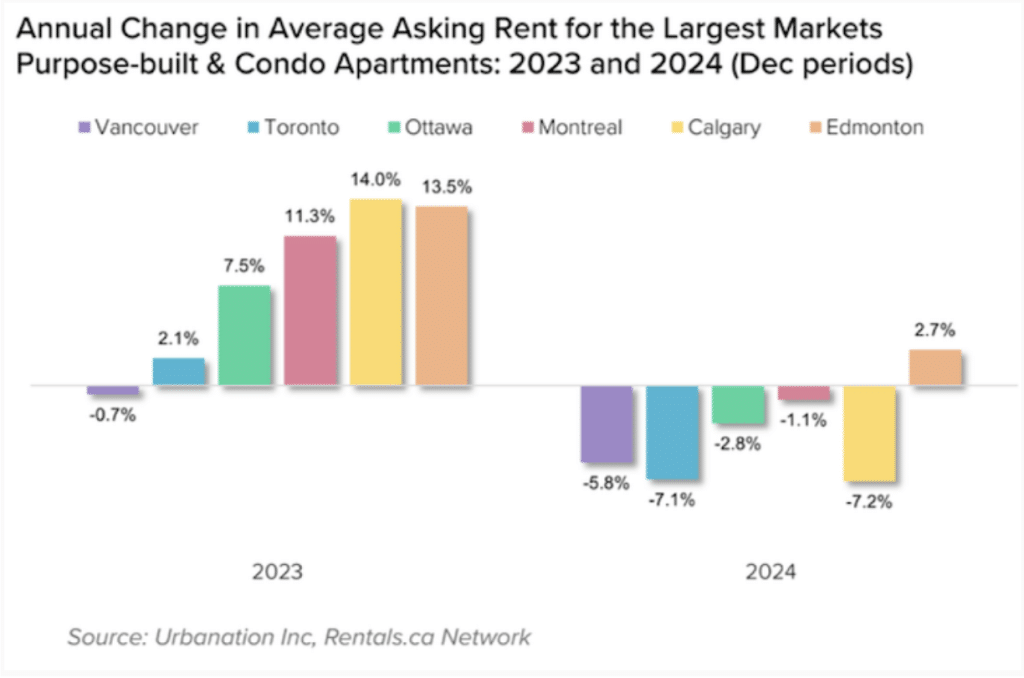

Rents Fell More than 7% in Toronto and Calgary

Apartment rents experienced a decline in 2024 across Canada’s five biggest markets, including a 7.1% decrease in the country’s largest market, Toronto, to an average of $2,632. This followed a 2.1% increase for apartment rents in Toronto in 2023. Apartment rents declined in Vancouver for the second straight year. Average apartment rents in Vancouver fell 5.8% in 2024 following a 0.7% decline in 2023, while still representing the most expensive of Canada’s largest markets with an average rent of $2,882.

After posting the fastest rent growth among Canada’s largest markets in 2023 with a 14.0% annual increase, Calgary’s apartment rents declined the most last year with a 7.2% drop to an average of $1,921. Average apartment rents in Calgary fell below the average in Montreal ($1,998) for the first time in two years as Montreal rents remained relatively stable in 2024, declining 1.1% following an 11.3% increase in 2023. Ottawa maintained its spot as the third most expensive among Canada’s largest markets, also posting a relatively mild 2.8% decrease in average apartment rents last year to $2,165.

Edmonton, the sixth largest rental market in the country, bucked the trend and saw average apartment rents rise 2.7% in 2024 to an average of $1,506, which followed 13.5% growth in 2023. However, apartment rents in Edmonton have begun to slow considerably, declining 6.5% over the past three months.

What Investors Should Do Next

So, what does all this mean for you? The rental market isn’t crashing—it’s adjusting. If you’re a real estate investor, here’s how you should respond:

1. Focus on High-Demand Markets

Some cities and provinces are seeing rents drop, while others are growing. Rentals.ca’s report suggests that Alberta and Saskatchewan remain strong bets, while Vancouver and Toronto may need a more strategic approach.

2. Follow the Affordability Trend

With renters prioritizing affordability, smaller units and budget-friendly properties are becoming more desirable. Investors should take this into account when buying or developing rental properties.

3. Watch for Buying Opportunities

If declining rents lead to lower property prices, this could present a chance to acquire assets at a discount. Keep an eye on the market for opportunities to buy undervalued properties in key areas.

Final Thoughts: A Market in Transition

According to Rentals.ca’s National Rent Report, the Canadian rental market is shifting. After years of rapid increases, we’re seeing stabilization—and even declines—in key markets. But this isn’t a warning sign for investors; it’s an opportunity to adapt.

The best investors aren’t those who panic when the market shifts but those who recognize trends and pivot accordingly. Whether it’s focusing on high-growth regions, investing in the right property types, or targeting affordability-conscious renters, 2025 will be about strategy, not just speculation.