For most Canadians, the family home represents stability, comfort, and the cornerstone of financial security. But what many homeowners don’t realize is that the very same property sitting under their feet can also be a powerful engine for building long-term wealth — when used strategically.

That’s exactly what the Smith Manoeuvre was designed to do.

At its heart, it’s not a “hack” or an exotic investment tactic. It’s a simple, structured method of turning your mortgage — typically your biggest liability — into a tool that helps you build wealth and reduce taxes at the same time.

For real estate investors, this strategy can be a complete game-changer. It turns dormant home equity into an active investment resource, freeing up capital that can be used to buy income-producing properties, all while improving tax efficiency.

Let’s unpack how it works, why it’s so effective, and what you need to know before putting it into action.

What Exactly Is the Smith Manoeuvre?

The Smith Manoeuvre was created by Fraser Smith, a financial planner from British Columbia, who saw how Canadian homeowners were missing out on opportunities that their American counterparts had.

In Canada, mortgage interest isn’t tax-deductible — it’s simply an expense. But interest on money borrowed to invest is tax-deductible. So, Fraser designed a strategy that allows homeowners to convert non-deductible mortgage debt into deductible investment debt — one payment at a time.

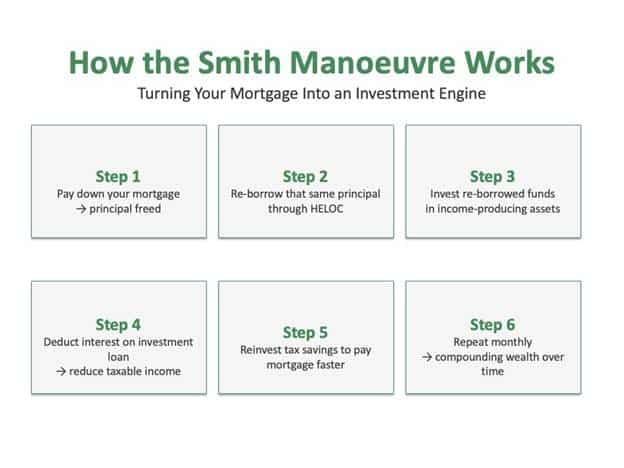

Here’s the idea:

- You pay your mortgage as usual.

- Each time you pay down the principal, you re-borrow that amount through a re-advanceable line of credit (HELOC).

- You then invest that re-borrowed money into income-generating assets — such as real estate, REITs, or private lending.

- The interest on that re-borrowed investment portion becomes tax-deductible.

Over time, your mortgage balance shifts from being purely personal debt to being investment debt — and the money you’ve invested begins working for you instead of sitting idle in your walls.

The brilliance of the Smith Manoeuvre isn’t in its complexity. It’s in the discipline of using your debt efficiently, the same way the wealthy do.

How the Strategy Actually Works

Let’s break it down in a clear, step-by-step example.

Imagine your home is worth $900,000, and your current mortgage is $450,000. You refinance into a re-advanceable mortgage that combines a traditional home loan and a line of credit under the same umbrella.

Each month, as you make your mortgage payment, a portion goes toward paying off principal. Let’s say you pay down $1,000 in principal this month.

That $1,000 instantly becomes available to re-borrow from your HELOC.

You re-borrow that $1,000 and invest it in an income-producing asset — like a rental property or private lending note that pays monthly interest.

The key is that the borrowed funds are used for investment, not personal use. Because of that, the interest on that portion of debt is tax-deductible.

As months turn into years, this cycle continues:

- You pay down your mortgage.

- You re-borrow the principal.

- You invest it again.

This creates a constant, self-funding investment loop that grows in strength as your equity grows.

Why Real Estate Investors Use It

The Smith Manoeuvre is often associated with stock investors, but it’s actually tailor-made for real estate investors. Here’s why:

- It multiplies your leverage safely. You’re using secured, low-interest borrowing to fund long-term, appreciating, income-producing assets.

- Your interest becomes tax-deductible. This can save you thousands of dollars a year and improve your overall after-tax returns.

- It accelerates portfolio growth. Instead of waiting to pay off your mortgage before investing, you’re investing continuously as you build equity.

- It compounds over time. Every payment you make fuels your investment base. After 5–10 years, the snowball effect can be dramatic.

For serious investors, the Smith Manoeuvre helps bridge the gap between owning your home and building lasting wealth from it.

A Practical Example in Action

Let’s walk through an example to make it real.

Home value: $900,000

Mortgage balance: $450,000

Re-advanceable limit: 80% of home value ($720,000 total borrowing room)

Every month, you pay down about $1,000 in principal. That $1,000 becomes available to re-borrow through your line of credit.

Now, you invest that re-borrowed $1,000 into a rental property or joint venture earning an average of 7% annual return.

At the same time, the interest on that $1,000 (let’s say at 6%) becomes tax-deductible.

Over a decade, if you repeat this consistently and your investments compound, your portfolio could easily grow into the six-figure range — all without additional cash flow from your pocket.

Meanwhile, your mortgage is being paid down on schedule, but the overall structure of your debt becomes increasingly efficient and wealth-building.

The Power of Tax Efficiency

The tax benefit is one of the biggest advantages of the Smith Manoeuvre.

In Canada, you can deduct interest on money borrowed to invest in income-producing assets. That means the interest portion of your HELOC becomes a tax deduction each year.

Let’s say your investment loan balance grows to $200,000, and your annual interest payments are $10,000.

If you’re in a 40% tax bracket, you could save around $4,000 per year in taxes.

That savings can then be redirected to further pay down your mortgage or reinvest — creating an additional compounding effect.

It’s a way of legally shifting money from the government’s pocket back into your own investment growth.

What You’ll Need to Set It Up Properly

To use the Smith Manoeuvre effectively and safely, structure matters. You’ll need:

- A re-advanceable mortgage. This is essential. Major Canadian lenders like Manulife, Scotia, and RBC offer them. It allows your credit line limit to automatically grow as you pay down principal.

- A clear investment purpose. The CRA only allows deductibility when borrowed funds are used for income-generating investments.

- Accurate bookkeeping. Track every re-borrow and investment separately from personal spending. Keep a clean paper trail.

- A financial team. A knowledgeable mortgage broker, accountant, and financial planner familiar with the Smith Manoeuvre is crucial.

- Discipline. This strategy rewards consistency and careful management — not emotional spending.

It’s a long-term, steady system. Done right, it’s one of the most efficient uses of home equity available to Canadians.

Advanced Strategies to Boost Results

Once you’ve mastered the basics, there are ways to enhance the Smith Manoeuvre even further:

- Cash Flow Diversion: Redirect your investment income or rental cash flow toward paying your mortgage faster. As you re-borrow that principal, you’re effectively compounding the cycle at a faster pace.

- Debt Swap: Use proceeds from selling a non-performing investment to pay down the mortgage, then re-borrow that amount to reinvest into higher-performing assets.

- Rempel Maximum: Borrow the full amount of available equity upfront to invest immediately rather than gradually. This can amplify results but requires strong cash flow and risk tolerance.

These variations can supercharge your returns — but they also require meticulous tracking and careful planning.

Common Pitfalls to Avoid

Despite its potential, the Smith Manoeuvre is often misunderstood. Avoid these mistakes:

- Mixing personal and investment funds. This voids the deductibility of your interest. Keep them separate.

- Over-leveraging. Don’t use the strategy as a way to overextend. It’s about efficiency, not recklessness.

- Ignoring interest rate risk. If rates rise, ensure your cash flow can handle the change.

- Skipping professional advice. The tax rules are precise. A professional accountant familiar with this strategy is worth their weight in gold.

Remember: the Smith Manoeuvre isn’t about chasing returns — it’s about maximizing what you already have.

Who It’s Best Suited For

This strategy isn’t for everyone. It works best for:

- Homeowners with significant equity and a long-term outlook.

- Investors who understand leverage and use debt responsibly.

- Those with stable income and good credit standing.

- Individuals who already invest or plan to invest in income-producing assets.

If you’re early in your financial journey or uncomfortable with borrowing, focus first on stability. Once you have a solid foundation, the Smith Manoeuvre can become an exceptional accelerator.

The Long-Term Payoff

Over time, the Smith Manoeuvre transforms how your money flows:

- You’re reducing your non-deductible debt every month.

- You’re investing continuously, not waiting for “someday.”

- You’re growing an investment portfolio alongside your home equity.

- You’re reducing taxes each year, freeing up additional capital.

That’s how you build wealth quietly, steadily, and efficiently. It’s not flashy — but it works.

This is how disciplined investors use time, structure, and strategy to create long-term financial independence.

Final Thoughts

The Smith Manoeuvre isn’t a secret or a shortcut — it’s a system. It rewards patience, consistency, and financial discipline. When executed properly, it can turn an ordinary mortgage into a lifelong wealth strategy.

For real estate investors, it’s one of the few ways to grow faster without needing to earn more income — you’re simply making your existing capital more productive. Your home is more than a roof over your head; it’s a foundation that can help you build financial freedom. The key is learning how to make it work for you, not just sit there.