If you’ve been following the housing market lately, you’ve probably noticed something that hasn’t been common in years: listings are piling up. Homes aren’t moving quite as fast. Sellers are adjusting their expectations. And buyers — including investors — have more time to think before making a move.

After more than a decade where properties seemed to vanish the moment they hit the market, the shift feels almost unfamiliar. But this change isn’t a fluke. It’s part of a broader reset taking shape across the country as Canada works through the aftereffects of rapid growth, rising rates, and a cooling economy.

What makes this moment especially interesting is that it holds both opportunity and risk, often in the same street, neighbourhood, or city. Investors who understand the difference between the two will be in a far stronger position than those relying on old habits or assumptions built during the frenzy years.

Let’s break down what the rise in inventory really tells us, how various regions are handling it, and what investors should be thinking about as we move closer to 2026.

Why Inventory Is Building Up

When you see more listings sitting on the market, it’s tempting to think demand has collapsed. That isn’t the case. What we’re seeing is a collection of forces intersecting at the same time.

Borrowing costs remain a drag.

Even though rates have stopped climbing, they’re still high enough to push many buyers to the sidelines. People who might have stretched to buy a year or two ago now look at the monthly payment and decide to wait. That alone slows demand.

A wave of recent construction is coming online.

Cities like Toronto, Vancouver, Calgary, and Ottawa approved thousands of units when the market was red-hot. Those properties are now completing, adding to active supply.

Sellers are adjusting to a slower rhythm.

Some sellers are pricing too high based on yesterday’s market. Others are trying to downsize, relocate, or lock in their equity before conditions shift again. When pricing doesn’t match demand, listings sit.

Some regions are simply returning to balance.

After years of near-constant bidding wars, a calmer market looks unusual but is long overdue. Rising supply doesn’t always mean trouble — in many cases, it means a healthier environment finally emerging.

A Country of Many Markets — Not One Story

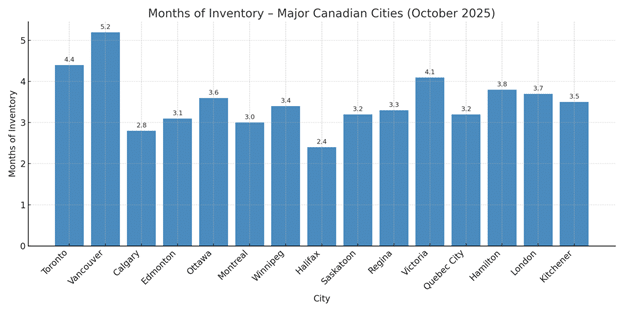

If there’s one message investors need to hold onto right now, it’s this: rising inventory doesn’t affect every region the same way. Canada’s housing scene is a patchwork of local stories, each with its own rhythm.

Ontario and BC: The biggest adjustments

The most noticeable rise in listings is found in Toronto, Hamilton, Vancouver, Victoria, and their surrounding regions. These markets soared during the last decade, and affordability never quite caught up. With higher borrowing costs, buyers are more cautious, and the number of active listings has climbed faster than in other provinces.

Homes take longer to sell. Prices aren’t dropping dramatically, but they aren’t rising with the same energy either. Investors in these regions must be precise — the days of relying on automatic appreciation are over for now.

The Prairies: A steadier environment

Alberta, Saskatchewan, and Manitoba tell a very different story. These provinces have benefited from affordability, job growth, and inter-provincial migration. Inventory is rising a little, but nowhere near the scale seen in Ontario and BC.

Investors continue to find workable numbers in cities like Edmonton, Calgary, Saskatoon, and Winnipeg. Cash flow hasn’t evaporated, and demand remains solid.

Quebec and Atlantic Canada: Quiet but strong

Montreal, Halifax, and Moncton are still seeing healthy activity. Prices remain more reasonable, and the inventory buildup isn’t alarming. In many ways, these markets represent what a functioning, stable housing sector should look like — predictable, steady, and not driven by panic or speculation.

Where the Opportunities Are

A rise in inventory isn’t something to fear. In fact, for experienced investors, it can open doors that would never appear during a hot market. The key is being thoughtful rather than reactive.

More room to negotiate

This might be the most refreshing change of all. Investors no longer have to submit rushed offers with no conditions. Sellers are far more open to negotiating on price, terms, repairs, closing dates, and even creative arrangements.

Softer competition from emotional buyers

During the boom years, investors found themselves competing with first-time buyers making decisions based on urgency rather than math. As emotional buyers step back, logical buyers gain an edge — and that’s where well-structured deals start to re-emerge.

Opportunities hidden in assignments and renewals

Some pre-construction buyers who purchased at peak prices are discovering they can’t qualify at current rates. Others face renewal shock on their existing properties. These situations don’t always become public distress, but they often result in motivated sellers willing to make a fair deal.

Better conditions for value-add projects

Renovation-based strategies thrive in slower markets. Contractors aren’t booked for months. Material delays ease. Purchase prices stabilize. Investors with patience and a clear plan can reposition a property more effectively when they’re not competing with every homeowner in the city.

The chance to buy quality rather than settle for whatever is left

One of the biggest problems during the hot years was that investors often bought properties they didn’t love, simply because nothing else was available. Rising inventory fixes that.

You can be selective again.

But Rising Inventory Also Comes With Real Risks

This next part is just as important. A cooling market can create mistakes just as easily as it creates opportunity. Investors need to be honest about the potential downsides.

Properties may sit longer than expected

If your plan requires quick resale or refinancing, the timing may not line up with the reality of the market. A project that takes longer to stabilize can put pressure on financing.

Oversupply in some condo-heavy cities

While not a nationwide issue, some cities have significant construction pipelines. If too many units close within a similar time frame, prices and rents can flatten — even in otherwise strong markets.

Rent growth isn’t guaranteed everywhere

Some areas will continue to see steady increases. Others may level off for a while. Investors who assume aggressive rent jumps could be disappointed.

Financing remains a challenge

Higher rates change everything — underwriting, renewal timelines, and cash flow expectations. Any deal that only works in perfect conditions should be avoided.

Not every “slow listing” is a bargain

Some homes sit because the seller overpriced them. Others sit because the property needs more work than expected or because the location doesn’t support strong rental demand. Rising inventory increases choice, but it doesn’t automatically increase quality.

A Look Toward 2026

The forecasts for 2026 aren’t predicting dramatic swings. Economists expect sales activity to pick up modestly after 2025’s slowdown, while prices in many regions may stay relatively close to today’s levels — slight dips in some provinces, slight increases in others. Nothing dramatic, but enough movement to signal a gradual shift back toward steadier conditions.

The important takeaway is that 2026 looks like a year where patience and disciplined buying could pay off, especially for investors who:

- Buy properties with strong fundamentals

- Look for areas where population growth supports long-term demand

- Choose markets that aren’t drowning in new supply

- Focus on numbers that hold up under stress-tested assumptions

This isn’t a cycle built for fast profits. It’s built for investors who understand that real estate wealth comes from buying solid properties during quieter times, managing them well, and giving them room to grow.

How Investors Should Approach the Market Right Now

Here are a few practical reminders for anyone looking to buy during this shift:

Zero in on local patterns

The difference between a great deal and an average one often comes down to what’s happening within a few blocks of the property. Pay attention to tenant demand, school zones, transit changes, and neighbourhood growth.

Run your numbers conservatively

If your deal only works under ideal conditions, it’s probably not the right one. Assume slower rent growth, higher carrying costs, and longer leasing timelines.

Be patient but ready to act

Good opportunities appear when motivated sellers meet ready buyers. You don’t need to rush, but you do need to be prepared.

Prioritize long-term stability

This is a cycle where buying quality wins. Focus on properties that would still make sense even if the market stays steady for a couple more years.

Final Thoughts

Rising inventory doesn’t mean the housing market is in trouble. It means conditions are shifting. It means buyers have room to think. It means investors can find deals without sprinting against ten other offers. And it means every city has its own story — some strengthening, some cooling, some quietly growing.

For investors willing to approach this market with clarity rather than urgency, the next couple of years could offer opportunities we haven’t seen in a long time. Not the fast, chaotic kind, but the steady, strategic kind — the kind that builds wealth quietly, one smart purchase at a time.