Real estate has always been a reliable choice for investors seeking long-term value and growth. But how can you make savvy real estate investments in a climate of inflation? Surprisingly, real estate has consistently outperformed inflation over the past few decades, making it a promising asset even during economic uncertainty. To maximize your success, you’ll need to employ the right strategies. Let’s explore the impact of rising prices and how you can navigate real estate investments during inflation.

Understanding Inflation’s Influence on Real Estate

To make informed decisions about real estate investments during inflation, it’s essential to comprehend how the market behaves under these economic conditions.

Impact on Purchasing Power

Inflation entails a gradual increase in the prices of goods and services, eroding the value of currency over time. In simpler terms, your money doesn’t stretch as far as it used to. To combat inflation, central banks typically raise interest rates, affecting all types of debt, including mortgages. This can reduce access to financing, potentially making real estate investments more challenging.

Effect on Development Costs

In an inflationary environment, property development becomes costlier. Land, materials, machinery, and labor expenses all rise, discouraging new construction. Existing properties become more sought after, driving up real estate prices, especially in areas with growing populations.

Rental Income and Inflation

Higher interest rates can price many potential homebuyers out of the market, increasing demand for rentals, both residential and commercial. However, vacation rentals and retirement properties may face reduced demand during periods of high living costs.

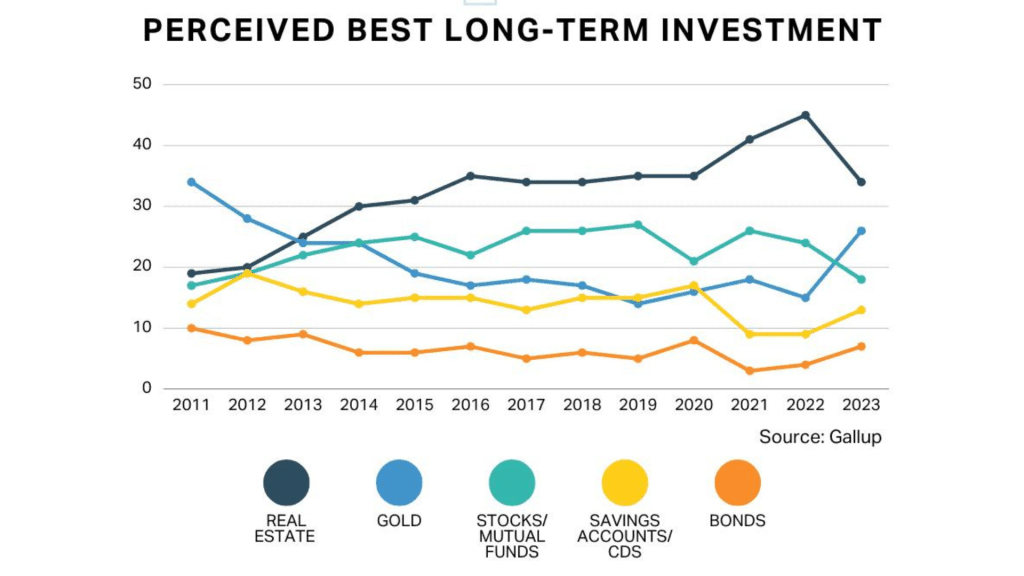

Real Estate vs Other Investments

Source: “Real Estate’s Lead as Best Investment Shrinks; Gold Rises,” Gallup

Appreciation and Inflation

In real estate, appreciation refers to the property’s increase in value over time, primarily driven by market demand. Higher demand translates to higher property values, especially when there are fewer new developments. Despite potential slowdowns due to rising mortgage rates, property prices generally continue to climb, making real estate a hedge against inflation.

8 Strategies for Successful Real Estate Investment During Inflation

Now that we understand the impact of inflation, let’s delve into eight strategies for thriving in the real estate market during inflationary periods:

1. Prioritize Cash-Flowing Properties

Focus on properties that generate substantial cash flow, such as rentals. These properties provide a steady income stream and perform well during inflation. Consider multi-family homes and commercial real estate and be prepared to adjust rental prices strategically.

2. Opt for Fixed-Rate Financing

Lock in a fixed interest rate for your borrowing needs to shield against potential future interest rate hikes. While initial costs may be higher, this approach ensures stable expenses, making financial planning more predictable.

3. Diversify Your Real Estate Portfolio

Spread your risk by investing in different property types and sectors. For instance, build a portfolio comprising residential and commercial properties, along with a few vacation rentals. Investing in properties across diverse locations can also minimize risk.

4. Invest in Real Assets and Development Opportunities

Seek properties with potential for improvement and profit. Consider “fix-and-flip” opportunities or develop land for future construction. Utilize construction industry accounting software to manage finances and ensure compliance.

5. Plan for Property Appreciation

Invest now to benefit from rising property prices and consider renovating properties to increase their value further. If interest rates decline, explore cash-out refinancing options.

6. Account for Inflation in Rental Rates

Offset higher property purchase costs by charging competitive rental rates. Adjust rents in line with inflation to cover your living expenses while ensuring your property remains attractive to tenants.

7. Consider Shorter Lease Terms

Short-term leases, including vacation rentals, allow for quicker rent adjustments. You can also convert short-term rentals into long-term options as needed, providing flexibility and potential tax advantages.

8. Monitor Economic Indicators

Stay vigilant about economic trends and market differences in the regions where you intend to invest. Keep an eye out for signs of economic downturns and adapt your strategy accordingly.

Final Thoughts

Understanding inflation’s impact on buying power, development, rental income, and appreciation is crucial for successful real estate investment in inflationary periods. Real estate remains a valuable asset that retains its worth and generates consistent income, making it a resilient choice amid economic instability. Follow these tips to make informed investments and prosper in the real estate market during inflation.