In the wake of the ongoing economic turbulence, Equifax Canada’s latest Market Pulse Consumer Credit Trends and Insights report paints a somber picture of the financial landscape. The report, covering the fourth quarter of 2023, indicates a concerning rise in delinquency rates across various credit products, reflecting the increasing financial strain on Canadian consumers. This blog post is a summary of the Equifax Market Pulse Report.

Rising Delinquency Rates In Ontario & BC

The data paints a concerning picture: mortgage delinquency rates in Ontario and British Columbia have soared, surpassing pre-pandemic levels. In Ontario, the delinquency rate skyrocketed by 135.2 percent compared to the previous year, while British Columbia saw a 62.2 percent increase.

These provinces, known for their higher housing costs, are also witnessing a troubling trend among financially stressed homeowners missing credit payments, particularly those aged 36 and younger.

Mortgage Renewal Woes

As consumers approach the end of their mortgage terms and face renewal, payment shocks are becoming more common, pushing some individuals to a tipping point. With interest rates on the rise, homeowners renewing their mortgages are experiencing substantial increases in their monthly payments.

On average, post-renewal mortgage payments increased by $457, with even higher spikes observed in Ontario and British Columbia. For those facing a monthly payment increase of more than $500, signs of deteriorating credit performance are becoming increasingly apparent.

Credit Card Debt Straining Canadians

Younger consumers, burdened with higher mortgage amounts and fewer savings, find themselves particularly vulnerable to financial stressors, leading to missed credit card payments—a worrying trend that reflects broader economic challenges.

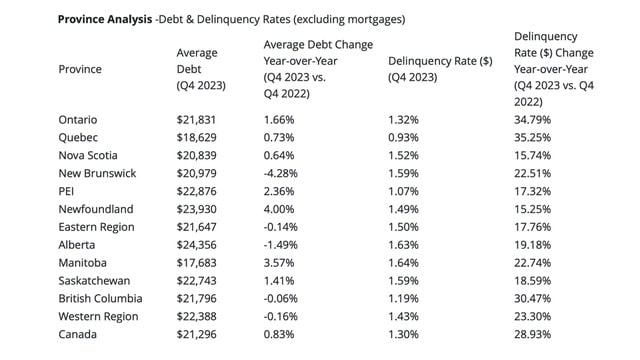

Total consumer debt reached a staggering $2.45 trillion, with non-mortgage debt rising by 4.1 percent. Credit card debt alone saw a $15.9 billion increase during 2023, reflecting a worrying trend of consumers relying more heavily on credit to make ends meet.

High Cost of Living, Missed Payments and Insolvencies

The high cost of living, coupled with stagnant wages and inflationary pressures, is exacerbating the situation, pushing more consumers towards financial distress. The report highlights a worrying increase in non-mortgage delinquency rates across various credit products, signaling impending challenges for many Canadians.

The disparity in housing prices between provinces like Ontario, British Columbia, and the rest of the country exacerbates the financial strain, contributing to heightened levels of delinquency and missed payments. While mortgage delinquency rates outside of these provinces are rising at a slower pace, they are still significantly lower than pre-pandemic levels.

Conclusion

As Canadians manage these turbulent financial waters, it’s crucial to prioritize financial literacy, seek support when needed, and explore strategies for managing debt effectively. Government intervention and support programs may also play a critical role in mitigating the impact of economic challenges on households.

Ultimately, proactive measures and prudent financial management are essential for weathering the storm and building resilience in the face of uncertainty.