Rentals.ca’s April 2024 report presents a comprehensive view of Canada’s changing rental market, indicating trends of cooling in previously overheated areas alongside continued growth in others. The report highlights complex dynamics shaped by economic recovery, demographic shifts, and new housing developments. Here’s a detailed breakdown of the report’s key findings:

Overview of National Rent Trends

Trends and Rates

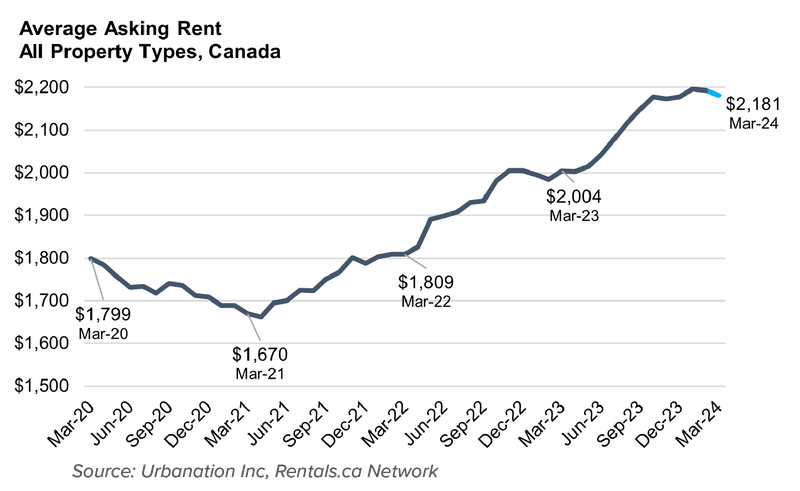

March 2024 sees the average asking rent across Canada standing at $2,181, marking an 8.8% increase year-over-year but a slight decline of 0.6% from the previous month. The trend suggests a deceleration in growth compared to the 10.5% annual increase recorded in February. This suggests that the explosive growth in rents observed over the past few years is beginning to stabilize.

Influencing Factors

Several factors contribute to the observed trends:

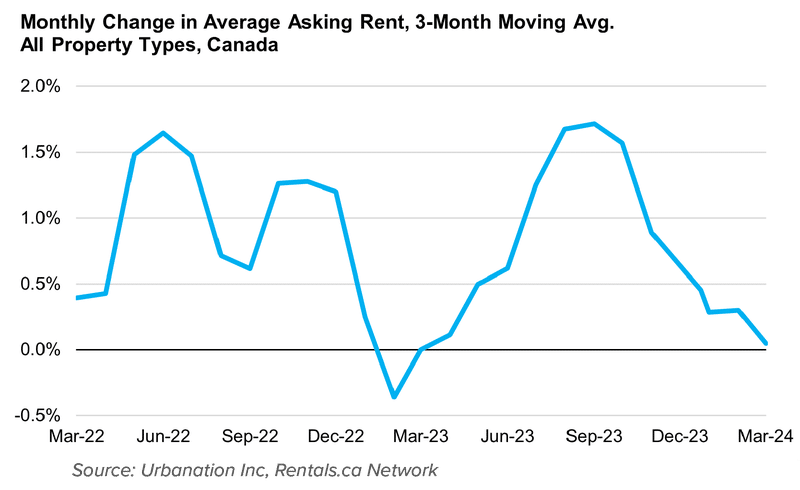

Seasonal Variations: Rent fluctuations often exhibit seasonal patterns, with peaks and troughs correlating with renter movement trends, which typically slow during winter months.

Economic Shifts: As Canada continues to adjust from the economic turmoil caused by the pandemic, shifts in the labor market and urban migration patterns significantly impact rental demands, especially in high-cost areas.

Supply & Demand: The introduction of new housing stock, particularly in urban centers like Toronto, has begun to impact rental prices, potentially easing the pressure caused by previously limited availability.

Detailed Property Type Analysis

Purpose-Built Rental Apartments

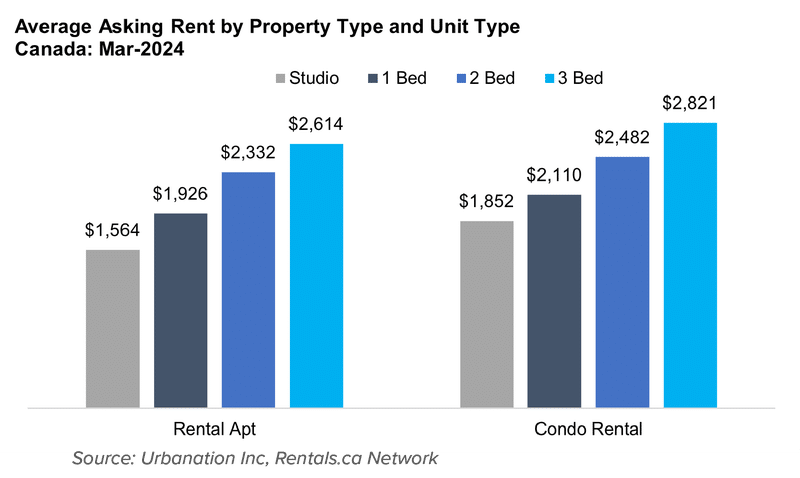

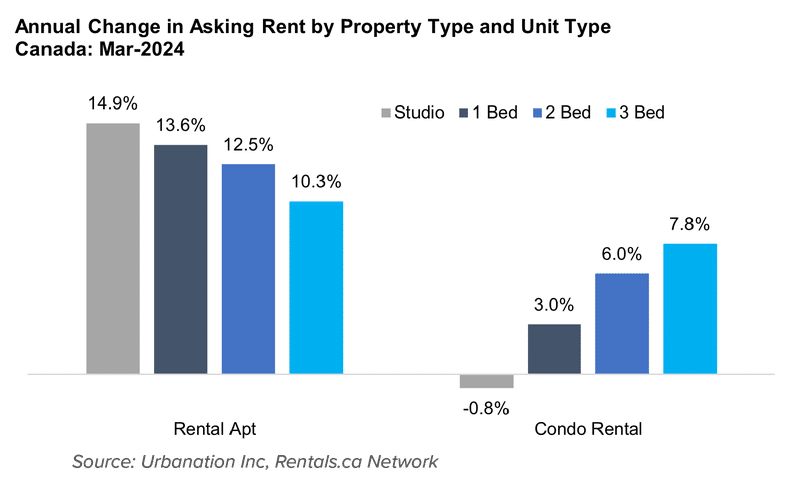

Purpose-built rentals have shown resilience with a stable 0.3% month-over-month growth in March and a notable 12.7% increase from the previous year, setting the average rent at $2,117. This sector’s strength likely stems from a combination of limited new constructions and a consistent demand from renters who prefer traditional apartment living.

Condominium Apartments

The condo rental market contrasts sharply, experiencing a 2.2% decrease from February to March and a modest annual growth of 3.9%. The surge in condominium completions, particularly in Toronto, is likely easing rent pressures by expanding available rental inventories.

Provincial and Municipal Rent Overview

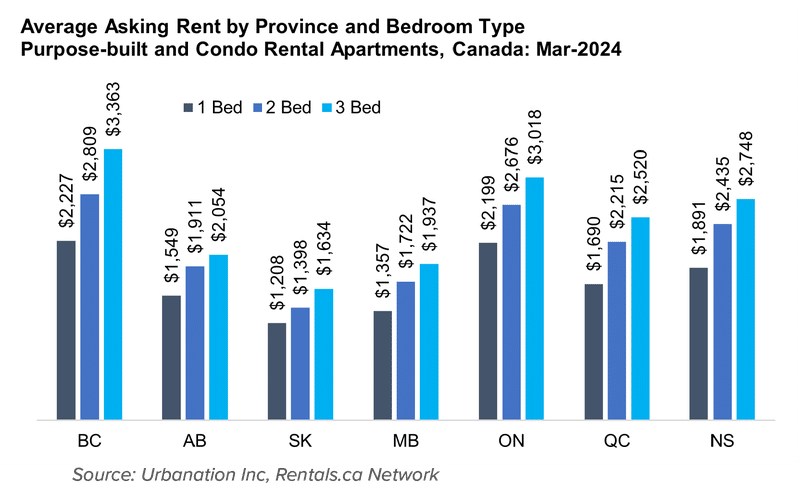

British Columbia and Ontario

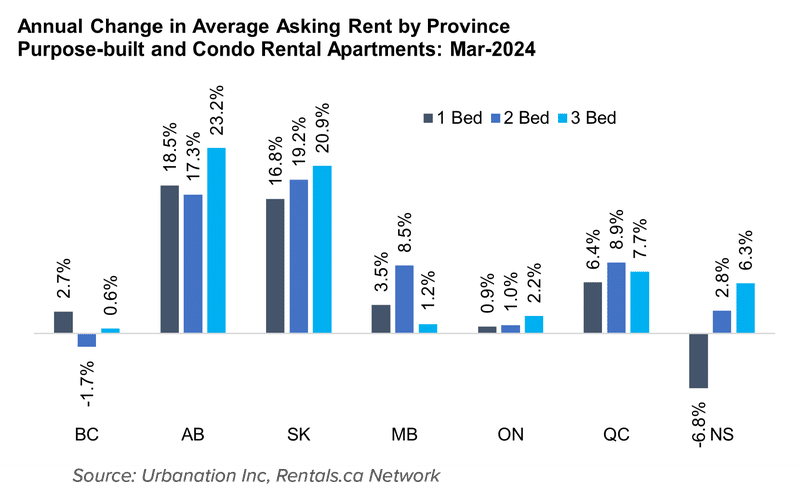

British Columbia: The province saw a slight increase in rents month-over-month by 0.5%, yet experienced a 1.9% decrease year-over-year, bringing the average to $2,494. The data suggests an adjustment phase where the market is reacting to previous rapid growth rates.

Ontario: Experiencing a decrease of 0.9% from February to March, Ontario’s average rent has reached a ten-month low of $2,410, with only a 0.4% increase year-over-year, indicating a potential market saturation or the impact of regulatory measures aimed at cooling the rental market.

Alberta and Saskatchewan

Alberta: This province shows the fastest growth in rent across Canada, with a striking 18.3% year-over-year increase. This suggests a robust economic rebound and an influx of residents seeking opportunities in the region.

Saskatchewan: Following closely, Saskatchewan recorded an 18.2% annual increase and the highest month-over-month growth at 2.7%, indicating strong demand and possibly limited supply.

Municipal Cities

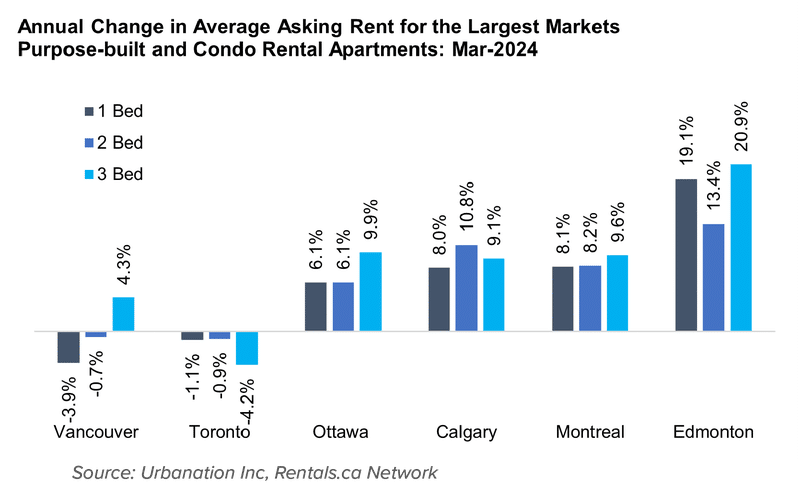

Vancouver: Marked a significant adjustment with rents decreasing by 4.9% from the previous year, falling below $3,000 for the first time since July 2022. This may reflect a market correction following prolonged high growth.

Toronto: Echoes the cooling trend with a 0.7% month-over-month decrease and a 1.3% annual drop, possibly due to increased housing supply.

Calgary and Edmonton: Both cities are on different trajectories, with Calgary experiencing a robust 9.8% annual growth and Edmonton presenting even more dramatic growth in specific sectors, notably with a 20.9% increase in three-bedroom rents.

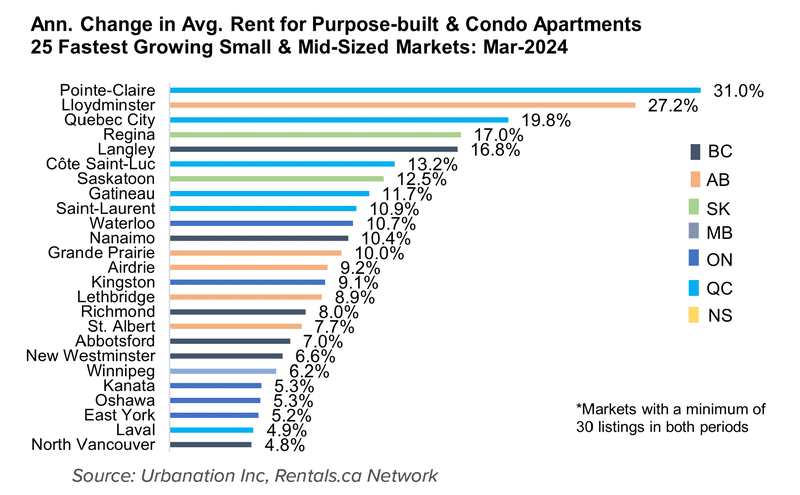

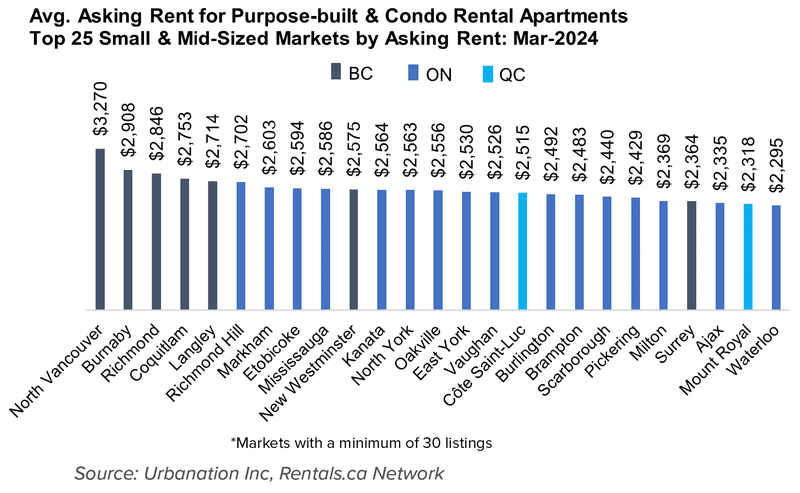

Emerging Trends in Smaller Markets

Remarkable rent increases in smaller markets like Pointe-Claire and Lloydminster illustrate significant demand spikes, possibly driven by localized economic developments or emerging as attractive residential alternatives due to affordability.

Conclusion

The April 2024 Rent Report from Rentals.ca paints a complex picture of the Canadian rental market, characterized by regional variability, and influenced by a mix of economic recovery, demographic changes, and new developments. Understanding these trends is crucial for investors to navigate and anticipate the future environment of Canada’s housing market.