If you’ve been feeling like Canada’s real estate market has been sending mixed signals lately, you’re not wrong. Some provinces are heating up while others are cooling off. Prices are slipping in some of the major markets, yet activity is climbing nationally. So… what gives?

Let’s unpack what’s really going on across the country, using the latest housing market data from August 2025—just released by WOWA.ca.

Average Home Prices: Up, Down… or Both?

Across Canada, the national average home price came in at $664,078 in August. That’s down 1.3% from July, but still up 1.8% from this time last year. In other words, prices are softening month-to-month, but we’re still trending higher than where we were in 2024.

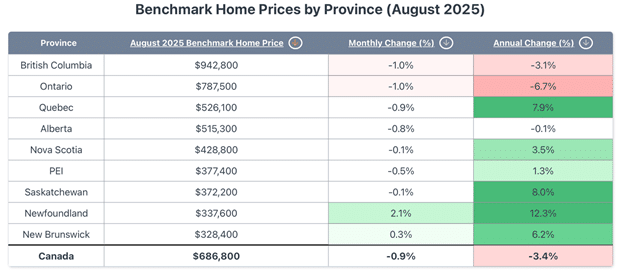

Now if you go by the benchmark price (which gives a more stable look at what a “typical” home is worth), that’s sitting at $686,800—a 0.9% drop from July, and down 3.4% year-over-year. That decline is largely thanks to big markets like Ontario and BC dragging down the national numbers.

Sales Are Up—But Not Everywhere

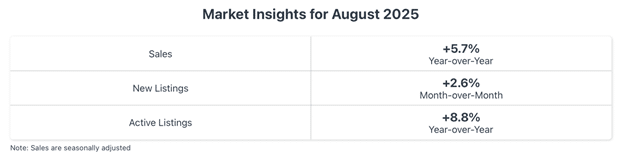

One thing that stood out this month: sales activity is actually up. Nationally, we saw 40,714 transactions in August, which is up 1.1% from July, and 5.7% higher than August 2024.

New listings also climbed 2.6% month-over-month, while active listings were up a solid 8.8% year-over-year.

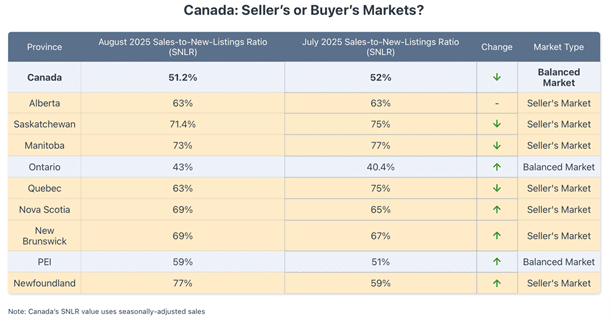

So even with rates still elevated and buyers cautious, people are still buying and selling. The sales-to-new-listings ratio (SNLR) was 51.2%—which puts Canada firmly in “balanced market” territory.

The Province-by-Province Breakdown

Here’s where things get interesting. Depending on where you look, it’s either full steam ahead—or steady cooling.

Where Prices Are Falling

- Ontario: Benchmark dropped to $787,500, down 1.0% month-over-month and a notable 6.7% year-over-year.

- British Columbia: Down 1.0% monthly and 3.1% annually, bringing the benchmark to $942,800.

- Alberta: Slight drop to $515,300, with almost flat movement year-over-year (-0.1%).

These three provinces represent a big chunk of Canada’s housing activity, so when they cool down, they pull the national averages down with them.

Where Prices Are Climbing

- Newfoundland: The star of the show—benchmark hit a record $337,600, up 2.1% monthly and a huge 12.3% year-over-year.

- Saskatchewan: Quietly on fire with an 8.0% annual gain.

- Quebec: Up 7.9% year-over-year, despite a small monthly dip.

- New Brunswick: Up 6.2% annually, and still posting modest monthly growth.

- Nova Scotia and PEI: Smaller gains, but still trending upward.

So while the headlines focus on Toronto and Vancouver slowing down, smaller markets—especially in Atlantic Canada and the Prairies—are still seeing solid growth.

Sellers vs. Buyers: Who’s Winning?

Whether you’re shopping for deals or offloading a property, the market dynamic can vary a lot depending on location.

Here’s the latest look at the Sales-to-New-Listings Ratio (SNLR) for August:

Even with prices softening in Ontario and BC, most of the country is still leaning seller-friendly, especially in the East Coast and Prairie provinces.

What’s Fueling All of This?

The Bank of Canada’s rate cuts since mid-2024 helped loosen the market slightly, but affordability is still a major challenge. Yes, borrowing is a little cheaper than it was a year ago—but with home prices still relatively high in many markets and wage growth not keeping pace, a lot of buyers remain on the sidelines.

In places where prices are still low (like New Brunswick or Newfoundland), we’re seeing the benefit of that rate relief. But in the pricier provinces? The lower rates aren’t enough to offset affordability issues.

So… What Does This Mean for Investors?

If you’re an active investor or looking to get into the market, this is one of those moments where local market knowledge really matters. National stats are helpful, but what’s happening in your province or city may look very different.

A few takeaways:

- If you’re in Ontario or BC, you might see more motivated sellers and better deals.

- If you’re in New Brunswick, Newfoundland, or Saskatchewan, expect competition—it’s a seller’s world right now.

- Rising listings mean more selection, which can benefit buyers—but only if you’re prepared and pre-approved.

- Lower interest rates offer some breathing room, but affordability pressures are still very real.

Final Thoughts

Canada’s housing market isn’t headed for a crash—but it’s clearly recalibrating. We’re seeing a bit of a tug-of-war between rising inventory and stubborn affordability challenges. And while the big-name provinces are cooling, several others are quietly picking up steam. If you’re buying, don’t just watch the national headlines—watch the metrics in your target market. If you’re selling, know that demand hasn’t dried up, but buyers are getting pickier. And if you’re just trying to figure out what the heck is going on… well, now you’re caught up.