If you’ve been watching the rental market across Canada over the last few months, you’ve probably noticed something interesting. After years of skyrocketing rents, bidding wars on basic units, and rental increases outpacing wage growth, things are starting to… shift.

Not collapse. Not crash. But Shift.

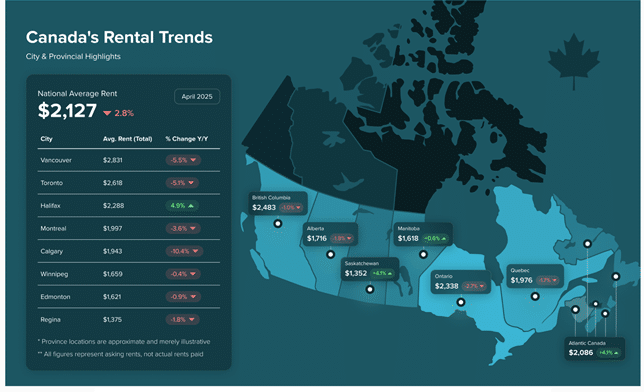

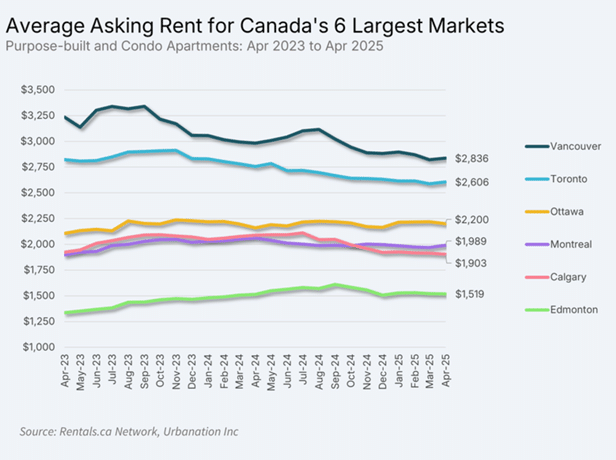

The latest National Rent Report from Rentals.ca and Urbanation (based on April 2025 data) confirms what many investors and tenants alike have already been feeling: rents in Canada are softening, particularly in some of the country’s most expensive cities. But at the same time, other regions are still quietly climbing — especially more affordable provinces and secondary cities that are absorbing demand from priced out tenants.

Here’s what you need to know right now — whether you’re a landlord, investor, tenant, or just trying to make sense of what’s happening in the rental space.

The Big Picture: Average Asking Rents Are Slipping (But Not Crashing)

Let’s start with the headline stat: the average asking rent in Canada fell 2.8% year over year in April, landing at $2,127.

That might sound like a small number, but it marks the seventh straight month of annual rent decline — something we haven’t seen in years. That said, rents are still roughly 28% higher than they were back in April 2021, when the pandemic had rental prices in a chokehold.

So what does that mean? In short: yes, things are softening. No, we’re not going back to pre2020 pricing.

There’s still a supply crunch in many markets. But high borrowing costs, inflation fatigue, and a wave of new purpose-built rental supply are finally putting some pressure back on landlords — especially in cities where tenants are pushing back on steep prices.

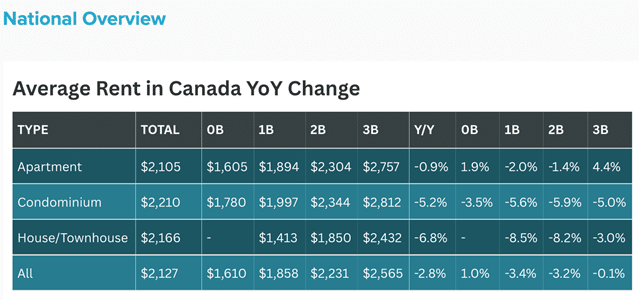

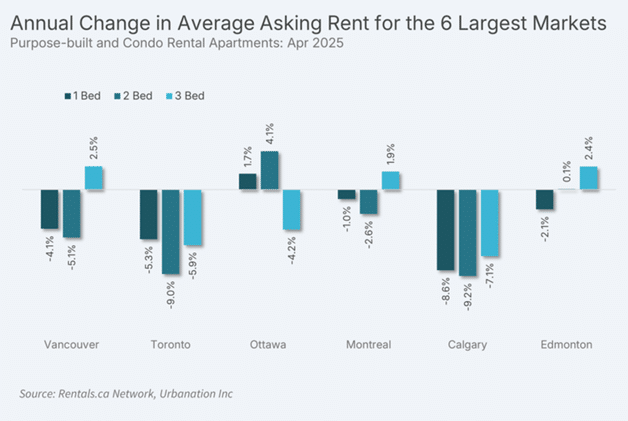

Rent Growth by Unit Type: The Gap Is Growing

When you break things down by property type, the trends get more interesting.

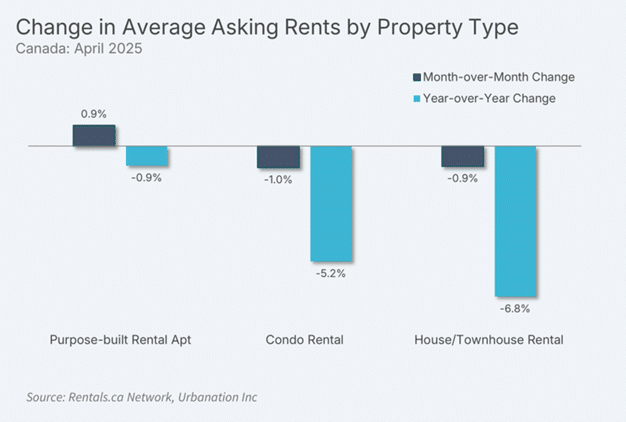

Purpose built rentals (your standard apartment buildings, generally owned by landlords and REITs):

These saw a 0.9% month over month increase in April, bringing the national average to $2,105. That’s only down 0.9% year over year, meaning these types of rentals have held their value better than others.

Condo rentals (individual condo units listed by investors):

These continue to drop. Rents fell 1.0% from March and are now down 5.2% year over year, sitting at an average of $2,210. Two bedroom condos saw the biggest hit — down nearly 6%.

If you’re a landlord renting out a condo, this matters. While purpose built buildings are seeing slight upticks (possibly thanks to newer inventory and incentives), condo owners are feeling the pinch — and may need to adjust pricing or incentives to stay competitive.

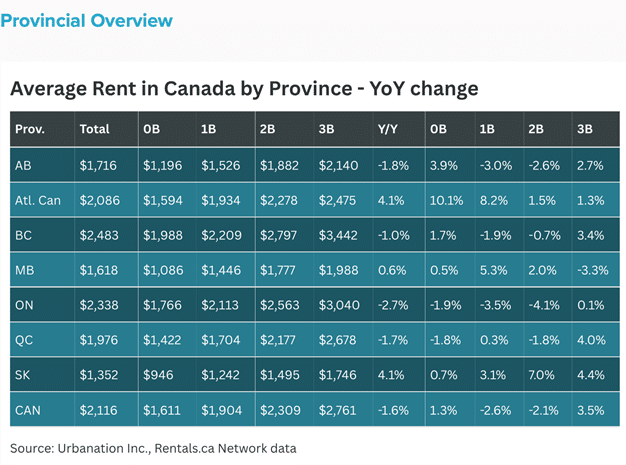

Which Provinces Are Up… and Which Are Slipping?

This is where the market tells two very different stories depending on where you are.

Ontario

The biggest headline here: Ontario rents are down 2.7% year over year, settling at $2,338. It’s the steepest drop of any province. But month over month, rents did tick up slightly (0.5%), which could hint at a plateau forming — or at least some stabilization. Toronto’s softness is playing a big role here, especially in condo heavy areas.

British Columbia

Rents in B.C. dipped by 1.0% annually, coming in at $2,483. Again, this is largely due to declines in high priced areas like Vancouver. For landlords used to naming their price, the balance of power is starting to shift — and renters are gaining some leverage, especially at the luxury end.

Alberta

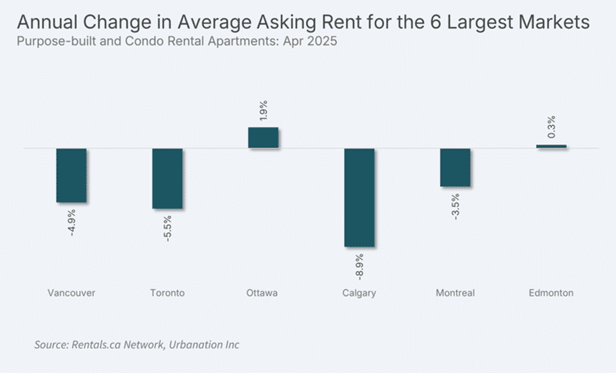

Alberta is cooling off, too. Rents dropped 1.8% year over year to $1,716. That said, Edmonton remains one of the most affordable major cities in the country, and Calgary—despite an 8.9% drop—still commands attention thanks to in migration and economic momentum.

Saskatchewan

Here’s the surprise winner: Saskatchewan saw the highest annual rent growth of any province, up 4.1%. The average rent? Just $1,352 — making it the most affordable market in the country. If you’re an investor looking for cash flow, this is a market worth watching.

What’s Happening in the Major Cities?

Let’s zoom into the key metros to see how things are really playing out on the ground.

Toronto

Rents dropped 5.5% year over year in April, marking 15 consecutive months of decline. The average asking rent for a Toronto unit is now $2,606. That’s still expensive, no question — but the air is definitely coming out of the tires. With many tenants choosing to stay put to avoid moving costs, landlords are having to offer incentives, flexible terms, or even lower rents to fill units.

Vancouver

Once again, Vancouver posted a 4.9% annual rent drop, now sitting at $2,836. That’s still the highest in the country, but for the 17th straight month, prices have declined. Combine that with rising property taxes, insurance costs, and new regulations, and landlords here are under pressure.

Calgary

One of the biggest reversals this year: rents in Calgary dropped 8.9% year over year. The average is now $1,903, which is still high for Alberta — but after months of headlines about Calgary being “the next investor hotspot,” we’re seeing some pullback. This doesn’t mean the market’s in trouble — but pricing may have outpaced what tenants were willing (or able) to pay.

Montreal

Montreal rents are also cooling. The average dropped to $1,989, down 3.5% year over year. Interestingly, Quebec is still attracting renters because of its relative affordability and lifestyle factors — but the market is clearly settling.

What This Means for Real Estate Investors

If you own rental properties, especially in major metros, this is a moment to pay attention.

We’re in a transitional market. Demand hasn’t disappeared — but renters are more price sensitive. They’re staying put longer, negotiating harder, and expecting more value for their money. In some markets, if you’re not pricing your unit competitively or offering at least something (parking, free month, flexible terms), you’re going to sit vacant longer than you used to.

At the same time, secondary markets and smaller provinces are seeing healthy growth — and not just because they’re cheaper. Many of these areas are seeing stronger job growth, population inflows, and less investor competition. That creates opportunity if you’re willing to look beyond the big city headlines.

Final Thoughts

Canada’s rental market is shifting — not crashing, not booming, but rebalancing. That’s not a bad thing.

For renters, this is a chance to breathe a little. For investors, it’s a moment to tighten operations, revisit your pricing strategy, and think about where your next opportunity might be. The markets that were red hot for the last couple of years are cooling — and the ones people used to ignore are starting to look a lot more appealing.

Whether you’re holding, expanding, or planning your next move, staying close to this kind of data is critical. Markets evolve. The best investors evolve with them. Need help tracking market shifts, analyzing deals, or finetuning your rental strategy? That’s exactly what we do inside Savvy Squad. Join the conversation, get support from other active investors, and make smarter decisions in markets that won’t wait around.