Rentals.ca has unveiled its highly anticipated Rental Market 2024 Outlook report. This report delves deep into the Canadian rental landscape, offering a roadmap for both renters and landlords. List below is a summary of their report that covers key insights to help our investors understand and navigate the trends that lie ahead.

Key Highlights

1. Balanced Growth Anticipated:

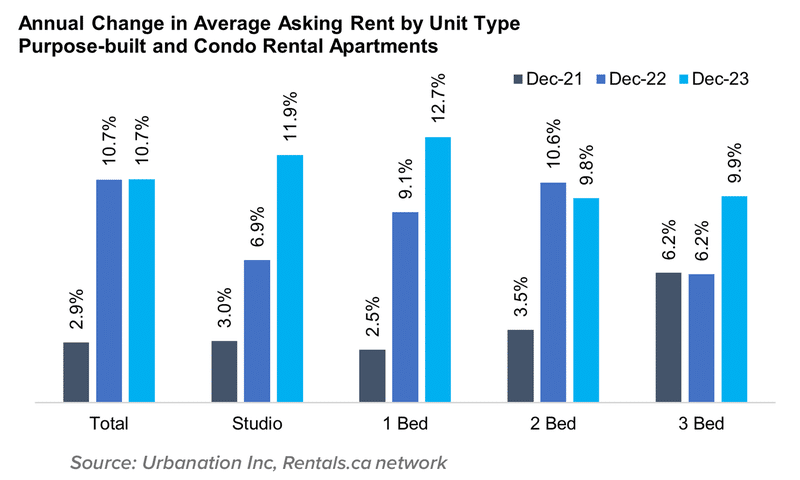

The Canadian rental market is expected to see a nuanced shift towards balance in 2024, albeit remaining undersupplied. Rent growth, a critical factor for both renters and landlords, is projected to converge towards its five-year average of around 5%. This convergence signals a more stable and predictable environment for the industry.

2. Factors Influencing Rental Demand:

The demand for rentals is expected to persist, although a moderation compared to 2023 is foreseen. This moderation is attributed to a combination of factors, including a slowdown in the economy, a decrease in non-permanent residents, and an increase in homebuying activity due to declining interest rates. Understanding these dynamics helps both renters and landlords anticipate market shifts.

3. Supply Dynamics and Tenant Turnover:

The report underscores the importance of supply dynamics and tenant turnover in shaping the rental market. With a continued rise in apartment completions and an uptick in tenant turnover, additional supply is anticipated. This injection of supply is a welcome relief for renters, potentially tempering rent growth and providing a more competitive market.

Provincial Overview

Alberta’s Above-Average Rent Increases:

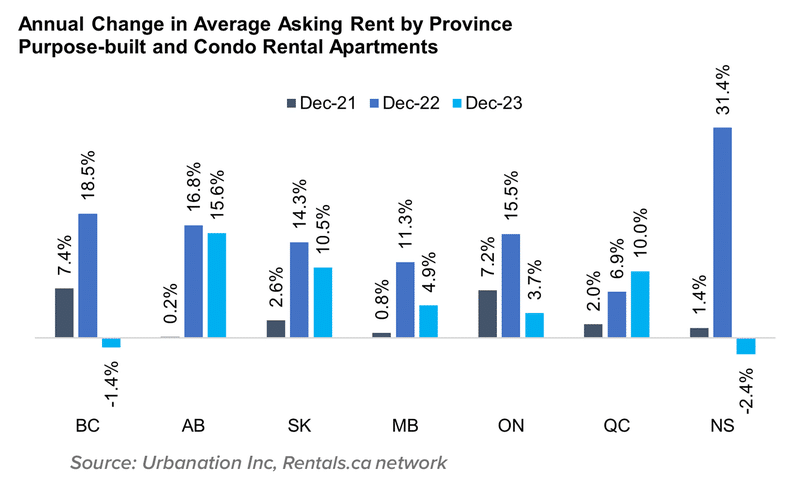

Alberta emerges as a standout in the rental landscape, with relatively affordable markets projected to experience above-average rent increases. This trend is rooted in the unique economic and demographic factors of the province, making it crucial for both renters and landlords to understand the regional nuances.

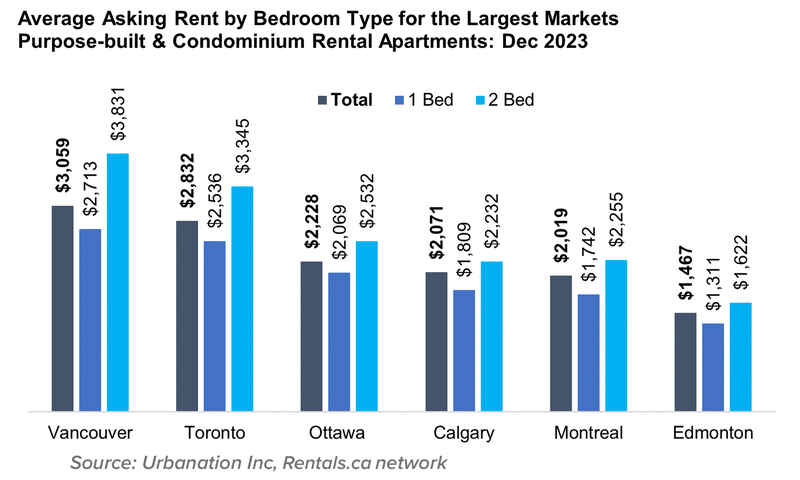

B.C. and Ontario’s Varied Rent Increases:

The regional disparity in rent increases between more expensive markets in B.C. and Ontario and the national average is a critical point of consideration. Renters in these provinces may face a different reality compared to their counterparts in other regions. This insight guides strategic decision-making for both tenants and property owners.

Rental Category Breakdown

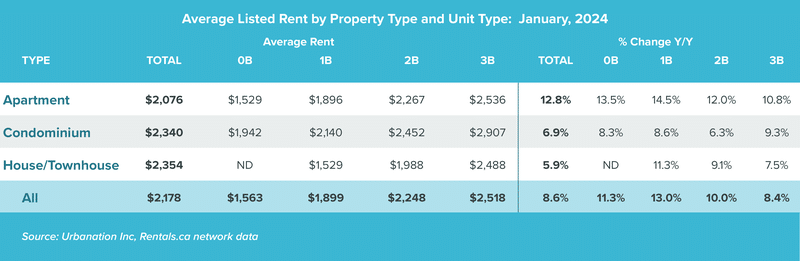

Fastest Growth in Traditional Apartment Rents:

Traditional purpose-built rental apartments take center stage with the lowest average rents in Canada but the fastest growth rate at 12.8%. Understanding this category’s resilience and growth potential provides valuable information for both investors and renters.

Regional Variances in Rental Growth:

A deeper dive into regional rental growth reveals the remarkable 16% increase in Alberta’s apartment rents in 2023. B.C.’s position as the most expensive province, despite a slight decrease, prompts reflection on the province’s market dynamics. Ontario’s slower rate of increase indicates a unique trend, while Nova Scotia’s year-over-year decrease underscores the need for local context in understanding rental shifts.

Municipal Overview

City and Market Insights

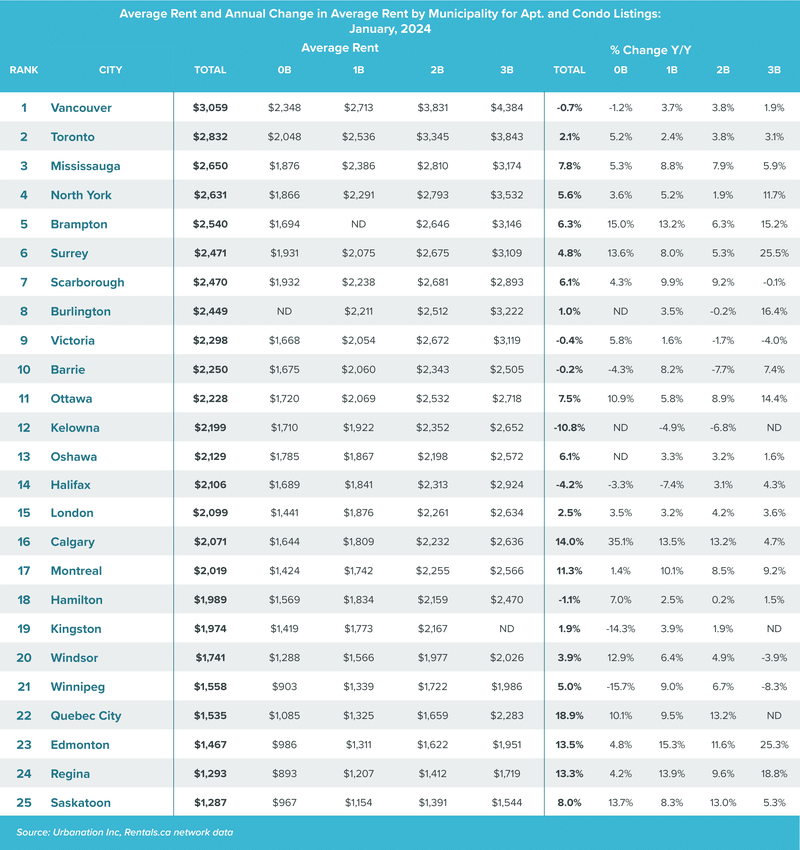

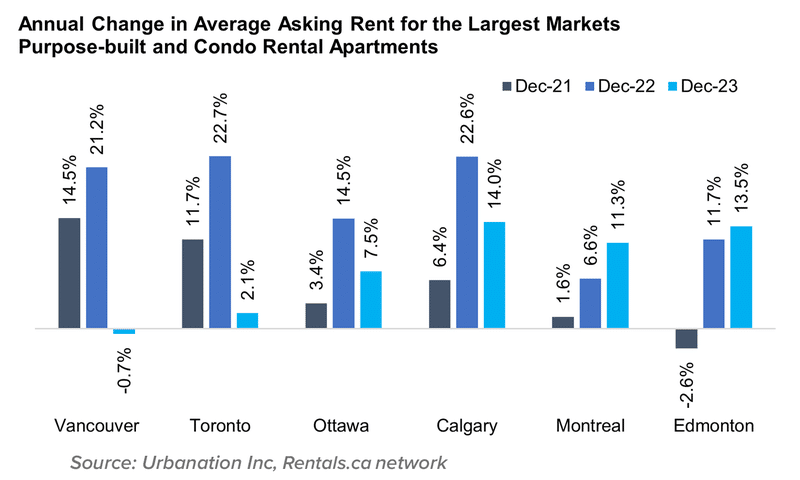

Calgary and Edmonton Lead in Rent Growth:

Among Canada’s largest cities, Calgary’s 14.0% annual rent growth in December stands out. The report sheds light on the city’s resilience and sustained growth, providing valuable insights for those navigating the Calgary rental market. Edmonton’s acceleration to 13.5% annual rent growth further underscores Alberta’s prominence, while Montreal’s 11.3% growth signals a dynamic urban landscape.

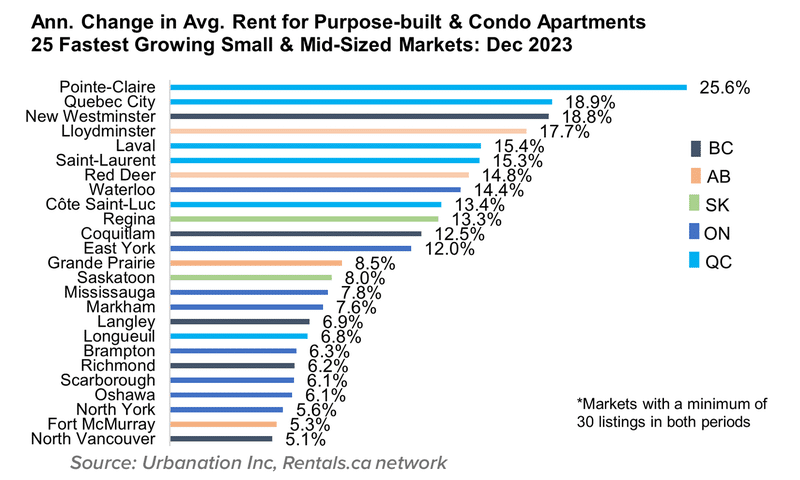

Quebec Markets Top List for Fastest Growing Rents:

The revelation of the four highest-priced small- and mid-sized markets for apartment rents in Canada being located in B.C. and Quebec provides a regional perspective. Notable mentions of Pointe-Claire and Quebec City, with substantial annual growth, invite deeper exploration into the unique dynamics of these markets.

Conclusion:

We hope this information helps support you with planning for this coming year. Whether you’re a seasoned investor or just dipping your toes into the market, we believe in the importance of having unbiased information to help you plan strategically for the year ahead. Here’s to clarity, insights, and successful investment decisions for 2024!