The recent federal budget announcement has set the stage for a significant alteration in the capital gains tax landscape, which is sparking a frenzy of discussions and prompting individuals and businesses to reassess their financial strategies.

This change, slated to take effect on June 25, 2024, will modify the inclusion rate for capital gains, impacting investors, property owners, and estate planners alike. In this blog, we’ll break down the capital gains tax changes, who it impacts, and strategies you might consider to mitigate the effects.

Understanding the Capital Gains Tax Changes

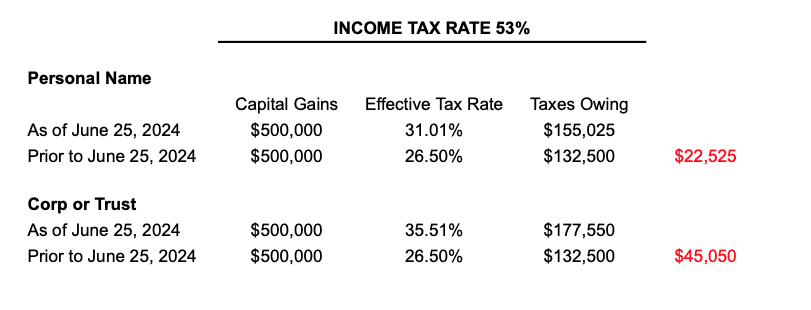

Currently, when individuals sell capital property, excluding their principal residence, they’re taxed on only half of the capital gain. However, with the proposed budget changes, the inclusion rate is set to increase to two-thirds for gains realized after June 25, 2024. This alteration carries significant implications, especially for high-income individuals and real estate investors.

This comes from “Tax Fairness for Every Generation”, a new page on the Department of Finance website:

“To make Canada’s system more fair, the inclusion rate—the portion of capital gains on which tax is paid—for capital gains for individuals with more than $250,000 in capital gains in a year will increase from one-half to two-thirds. Individuals will continue to only pay tax on 50 per cent of any capital gains up to $250,000 per year. The inclusion rate will also increase to two-thirds for all capital gains realized by corporations and trusts. The new rules will apply to capital gains realized on or after June 25, 2024.”

Implications for Real Estate Investors

Real estate investors, in particular, are poised to feel the impact of these changes. Under the current tax rules, if you dispose of capital property (other than your principal residence) for a profit, only half (50 per cent) of the capital gain is included in your taxable income. The budget proposed to increase the capital gains inclusion rate to two-thirds (66.7 per cent) for capital gains realized on or after June 25, 2024. For corporations and trusts, the higher inclusion rate applies to all gains realized on or after that date.

This means all gains realized before June 25, 2024, will be subject to the current 50 per cent inclusion rate, which is the rate that will apply to the first $250,000 of capital gains realized from June 25 onwards. Only any excess gains above $250,000 that are realized after June 25 will be subject to the new 66.7 per cent rate.

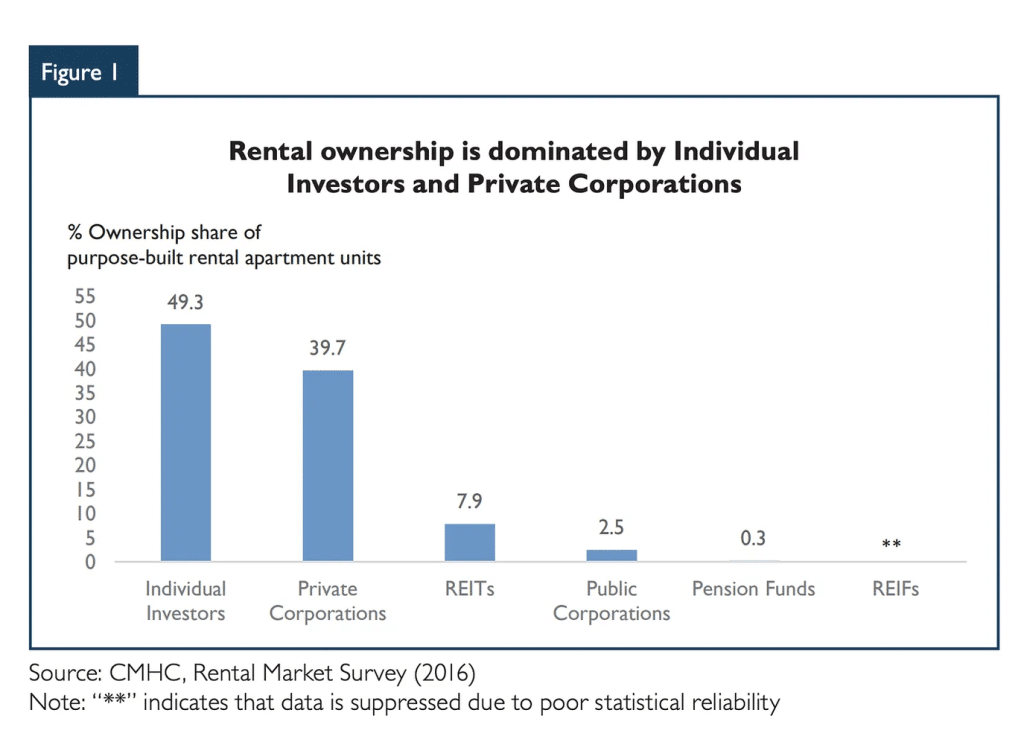

CMHC’s 2016 rental market survey found that after individual investors, 49.3% of owners, rental ownership was very much dominated by Private Corporations, owning 39.7% of rental apartment units.

Strategic Planning Considerations

In light of these changes, real estate investors may want to adopt proactive strategies to mitigate the impact on their financial portfolios. One avenue worth exploring is the option to realize capital gains before June 25, 2024. By doing so, investors can capitalize on the current 50 percent inclusion rate, thus reducing their overall tax liability.

For instance, a real estate investor contemplating the sale of an income property post-June 25 can strategically plan to trigger capital gains before the deadline to take advantage of the lower inclusion rate. This approach allows investors to optimize their tax position and preserve more of their investment returns.

Final Thoughts

The impending increase in the capital gains tax rate is a crucial development for real estate investors. Those who plan and act quickly can mitigate the impact of these changes. It’s important to consult with a tax professional to better understand these changes, how it impacts your portfolio and discuss a strategy that fits your specific situation and goals.