The landscape of Canada’s rental market underwent a profound transformation in 2023, marked by a surge in demand surpassing the available supply. This shift led to increasingly tighter rental markets, affordability concerns, and notable shifts in vacancy rates and rent growth across major cities.

The Rental Market Report for 2023, compiled by the Canada Mortgage and Housing Corporation (CMHC), serves as a comprehensive overview of these developments, offering insights into their ramifications for renters and policymakers alike. This blog post is a summary of the CMHC Rental Market Report.

Declining Vacancy Rates:

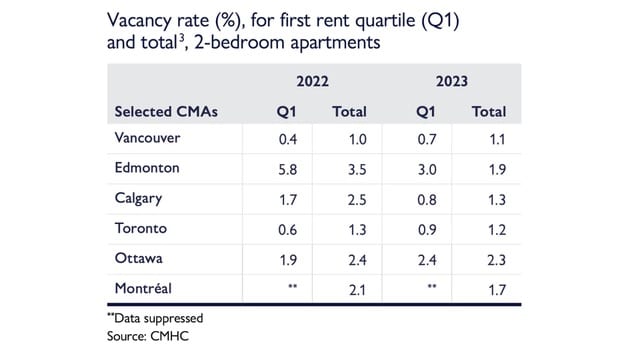

One of the most striking findings of the report is the decline in the national vacancy rate for purpose-built rental apartments, which reached a new low of 1.5% in 2023, down from 3.1% in 2020 and 2021. This decline was consistent across most major cities, with Toronto, Montréal, Calgary, and Edmonton reporting particularly significant decreases. These tighter markets signify a growing imbalance between supply and demand, with supply unable to keep pace despite an increase in the overall rental unit universe.

Rapid Rent Growth:

Concurrent with the tightening of rental markets, average rent growth for 2-bedroom purpose-built apartments surged to a new high of 8.0% nationally. This sharp acceleration in rent growth far outpaced both inflation and wage growth, exacerbating affordability challenges for renters. Cities like Toronto, Montréal, and Vancouver experienced notable increases in rent levels, reflecting the intense demand and limited availability of rental units.

Drivers of Rental Demand:

Several factors contributed to the robust rental demand observed in 2023. Strong immigration flows, particularly to major urban centers, fueled population growth and rental demand. Additionally, employment gains, especially among younger demographics, and the ongoing challenges of homeownership affordability further supported demand for rental housing.

Affordability Challenges:

Despite the growing demand for rental housing, affordability deteriorated significantly in 2023. Rent growth outpaced income growth by a wide margin, placing increased financial strain on renters, especially those with lower incomes. High rental costs relative to household incomes led to an uptick in arrears in several major cities, with Toronto experiencing the largest increase.

Supply Constraints and Policy Implications:

The report underscores the importance of addressing supply gaps to alleviate affordability pressures in Canada’s rental markets. Tightening vacancy rates for the most affordable units highlight the need for targeted interventions to increase the availability of affordable rental housing, particularly in high-demand urban centers.

Conclusion:

The Rental Market Report for 2023 paints a picture of tightening rental markets, soaring rent growth, and mounting affordability challenges across Canada. With demand consistently outpacing supply, policymakers and stakeholders must prioritize measures to expand the rental housing supply and improve affordability for renters across income levels. Failure to address these issues risks exacerbating housing insecurity and widening socioeconomic disparities in Canadian communities. Read the full CMHC Report by clicking here.