Canadian National Market Update: January 20025

WOWA just released its latest Canadian National Real Estate Market Update, and there’s a lot to unpack. This report takes a deep dive into the real estate market across different provinces, offering valuable insights for both homebuyers and investors.

To make things easier, we’ve pulled together some key takeaways from the report. Whether you’re looking to buy, sell, or just stay informed, these highlights will give you a clearer picture of where the market is headed.

Here’s what you need to know:

Canada

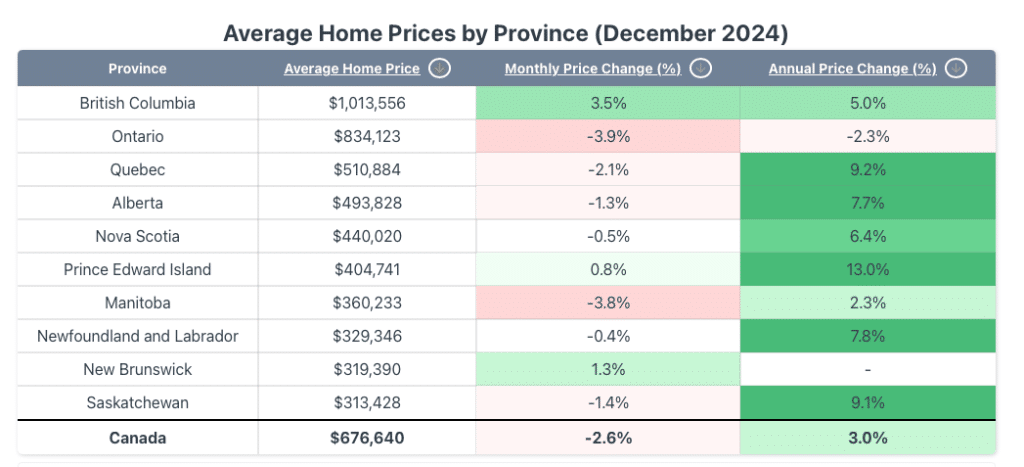

Canada’s housing market showed signs of moderation in December 2024, with the national average home price decreasing to $676,640, representing a 2.6% decline from November, as most provinces experienced a negative monthly price change. On an annual basis, the average Canadian home price is up 3% year-over-year.

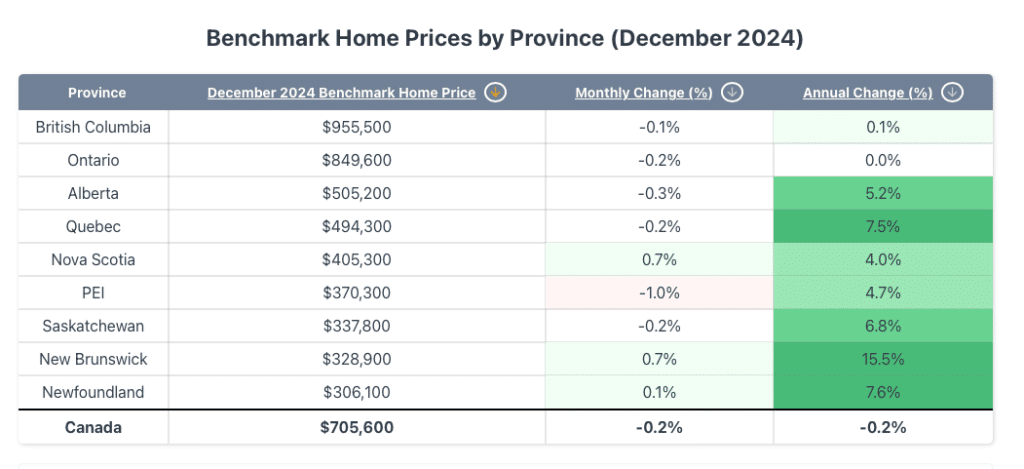

The national benchmark home price, which measures the price of a “typical” home, was $705,600, showing a 0.2% decrease month-over-month and 0.7% year-over-year.

Market Insights for December 2024

Nationally, home sales reached 43,239 in December 2024, a seasonally adjusted 3.0% decrease from the previous month. December is historically a slow period for the housing market, and December 2024 was no exception. However, sales are up 14% compared to December 2023. For some provinces, it was one of the hottest Decembers on record based on home sales. New listings were down 1.7% month-over-month, while active listings were up 7.8% year-over-year.

The large gain in home sales follows successive Bank of Canada rate cuts in June, July, September, and October 2024. Another jumbo 0.50% rate cut that occurred in December 2024 will further help fuel buyer activity. That’s because the Bank of Canada’s easing measures, aimed at stimulating economic growth, have reduced borrowing costs and lowered mortgage rates, drawing more buyers into the market.

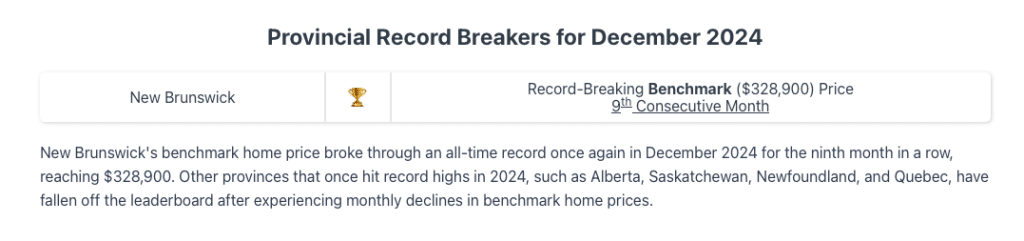

New Brunswick’s benchmark home price broke through an all-time record once again in December 2024 for the ninth month in a row, reaching $328,900. Other provinces that once hit record highs in 2024, such as Alberta, Saskatchewan, Newfoundland, and Quebec, have fallen off the leaderboard after experiencing monthly declines in benchmark home prices.

Benchmark Prices Across Canada

For December 2024, benchmark home prices rose on an annual basis in all provinces except for Ontario, which instead saw benchmark prices remain almost the same year-over-year. British Columbia continues to command the highest benchmark home price at $955,500, with an annual increase of 0.1%. New Brunswick led annual growth with a 15.5% increase, followed by Newfoundland with a 7.6% increase and Quebec with a 7.5% increase year-over-year. Despite gains in many provinces, the national benchmark home price dipped 0.2% year-over-year to $705,600.

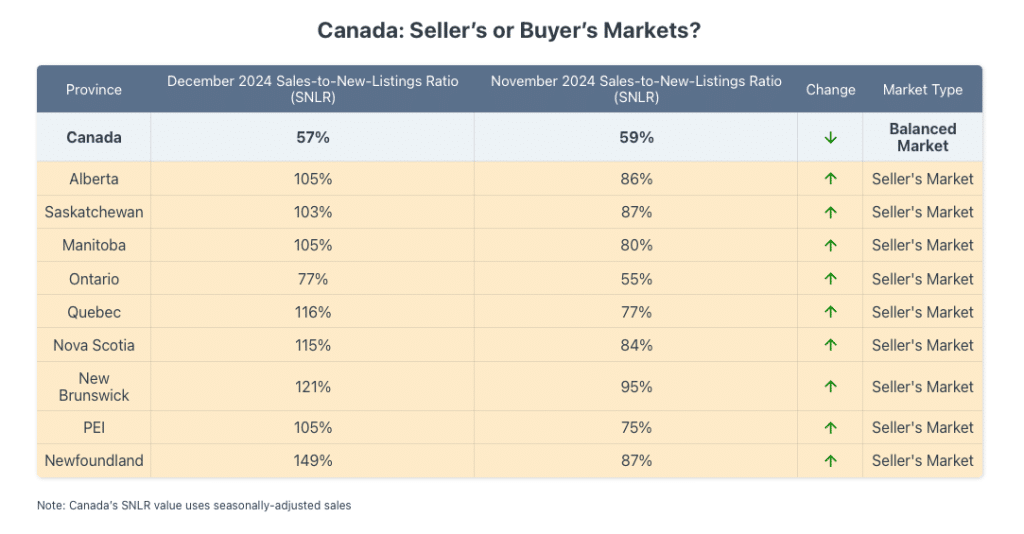

Sales To New Listing Ratio – SNLR

For December 2024, Canada’s sales-to-new-listings ratio (SNLR) declined slightly to 57%, keeping its status as a balanced market. Although it is close to the 60% threshold to be considered a seller’s market, this indicates that, on the national level, the equilibrium between supply and demand still allows sellers to receive reasonable offers while providing buyers with adequate choices.

An SNLR above 60% suggests a seller’s market characterized by limited buyer options and higher competitiveness. An SNLR below 40% signals a buyer’s market, indicating plentiful listings and increased buyer leverage. An SNLR between 40% and 60% represents a balanced market.

All of Canada’s provincial housing markets with reporting data for December 2024 exhibit seller’s market conditions, with all reporting provinces seeing an increase in their SNLRs compared to November 2024. Except for Ontario, the remaining provincial SNLRs are above 100%. That’s largely due to the seasonal slowdown in new listings that typically occurs in December each year.

Regional Analysis

Ontario

Ontario’s housing market saw its average home price decrease to $834,123, a 3.9% decrease from the previous month and down 2.3% year-over-year, the only reporting province this month to have a decrease in its average home price year-over-year. Ontario recorded 8,997 sales in December 2024, down 35% month-over-month but up 8.1% year-over-year. There were 43,779 active listings in Ontario’s housing market, the highest for the month of December in over 10 years.

The average home sold price in the GTA was $1,067,186 in December 2024, representing a decrease of 1.6% year-over-year and down by 3.5% month-over-month. Meanwhile, the GTA’s benchmark home price is up 0.2% year-over-year to $1,061,900.

GTA home sales are down 2.5% year-over-year, with 3,359 transactions in December 2024. The GTA’s SNLR was 72%, in seller’s market territory, lower compared to the province’s ratio of 77%.

British Columbia

British Columbia’s housing market had an average home price of $1,013,556, showing resilience with a 3.5% monthly increase and a 5.0% annual increase. That’s the largest monthly gain in average home prices among the provinces this month. BC’s average home price hasn’t been above $1 million since May 2024. Greater Vancouver’s average home price for December 2024 was $1,275,672, up 2.5% year-over-year.

Quebec

Quebec’s average home price was $510,884, down 2.1% from November 2024’s all-time high last month and 9.2% higher than the previous year. The province saw 6,748 sales, down 12.3% from the previous month while being up a significant 52% from the previous year. That’s up from a 41% year-over-year increase seen in November 2024.

The Montreal housing market saw prices rise 11% annually to an average price of $642,030 for December 2024, an all-time high. Quebec City’s average home price increased to $436,365, up 4.1% month-over-month and up 18.1% annually, an astounding year-over-year gain.

Atlantic Canada

Nova Scotia

Nova Scotia’s housing market saw a slight decline, with an average home price of $440,020, a 0.5% decrease from the previous month but up 6.4% from the previous year. Halifax’s average home price was $575,907, showing similar trends with a 0.1% monthly decrease but a 10.3% annual increase.

New Brunswick

New Brunswick’s average home price of $319,390 is a 1.3% month-over-month increase. New Brunswick’s SNLR of 121% is the second-highest among the provinces in December 2024. Fredericton’s average home price of $324,960 in December 2024 is down 0.6% monthly, Moncton’s $343,267 is down 3.4% monthly, and Saint John’s $360,270 is up 8.3% monthly. New Brunswick home sales, at 552, is the third-highest ever for the month of December.

Prince Edward Island

Prince Edward Island’s average home price rose to $404,741, a 0.8% increase from the previous month and a 13.4% increase from the previous year. The number of active listings at the end of December 2024 in PEI is the highest seen since in seven years, since December 2017.

Newfoundland and Labrador

Newfoundland and Labrador’s housing market showed strong growth, with an average home price of $329,346, representing a 0.4% decrease from the previous month and a 7.8% rise from the previous year. There were 5,686 homes sold in Newfoundland throughout 2024, the third-highest annual total for the province.

The Prairies

Alberta

Alberta’s average home price decreased to $493,828, down 1.3% monthly but still up 7.7% year-over-year. That’s a big drop after hitting $544,752 in October 2024, an all-time high. Meanwhile, looking at Alberta’s major cities, home prices in Calgary are up 12% year-over-year to $605,074, while Edmonton home prices had a 15% annual increase to $436,401.

Saskatchewan

The average home price in Saskatchewan decreased to $313,428, down 1.4% from the previous month but up 9.1% from December 2023. The province recorded 776 sales in December 2024, a 3% increase from the previous year and down 34% monthly.

Saskatoon’s average home price of $391,338 in December 2024 is up 8% year-over-year, while Regina’s average home price of $294,070 is up 6% year-over-year. On a monthly basis, they declined 0.7% and 4.6%, respectively.

Manitoba

Manitoba’s average home price in December 2024 was $360,233, a decrease of 3.8% month-over-month and up 2.3% year-over-year.