After three straight years of rising rents, the Canadian rental market has finally shifted gears—and the latest numbers from the Rentals.ca October 2025 report are showing it loud and clear. The average asking rent for a residential unit across Canada hit $2,123 in September. That’s not just a dip. It’s a 3.2% drop compared to last year, marking the 12th straight month of year-over-year declines.

That’s a big deal. From mid-2021 through late 2024, rents were going up month after month for 38 consecutive months. But now, the momentum has changed. Rents are down 1.2% over the last two years, a stat we haven’t seen since early 2022. And while the drop may not feel dramatic on the surface, it signals a meaningful shift in investor strategy and tenant behavior.

What’s behind the slowdown? According to the report, three main things are driving this change: a surge in new apartment completions, a reduction in non-permanent residents like international students and temporary workers, and a softening in the labour market. Put simply, there’s more supply hitting the market at a time when demand is getting more selective and price-conscious.

Not All Rentals Are Created Equal — And Not All Are Falling the Same Way

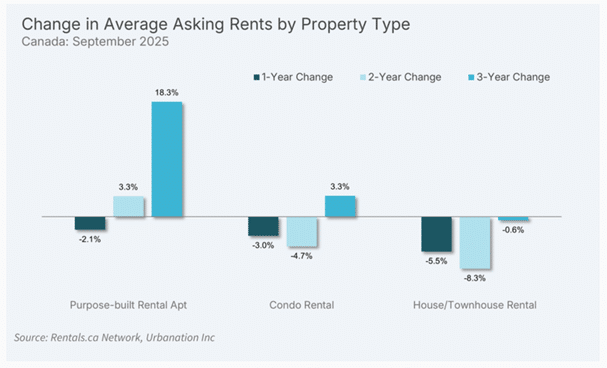

When you break the numbers down by type of rental, it becomes clear that some segments of the market are absorbing more of the hit than others. Purpose-built rentals have seen relatively modest declines, but it’s the secondary rental market—like condos and single-family homes being rented out—that’s showing deeper softening.

For example, purpose-built apartments are now renting for an average of $2,093, down about 2.1% compared to last year. Condos are averaging $2,226, down 3%. But it’s detached homes and townhouses that are seeing the biggest pullback, down 5.5%, with average rents now sitting around $2,178.

And it gets steeper when you look at two-year comparisons. Condos are down 4.7% over the past 24 months, and rental houses/townhomes are down a full 8.3%. This isn’t a blip—it’s a trend that’s starting to show staying power.

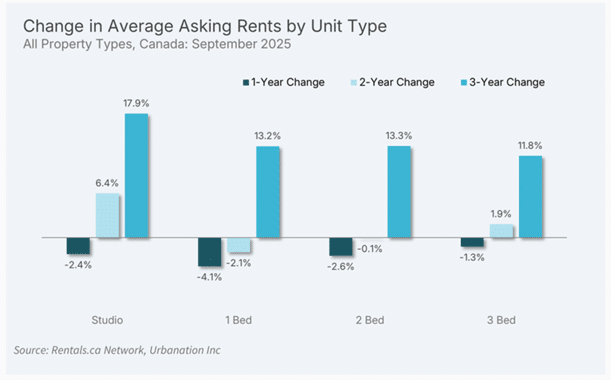

Smaller Units Are Feeling It More Than Larger Ones

There’s also a noticeable pattern when looking at unit sizes. One-bedroom apartments, often seen as starter rentals or transitional units, have dropped 4.1% year-over-year and now sit at an average of $1,836. Studios have fallen by 2.4%and now average $1,616. Two-bedroom units are holding a little better at $2,220, while three-bedroom units are still commanding higher rents at $2,561, only down 1.3%.

Interestingly, three-bedroom apartments in purpose-built and condo buildings are showing signs of stability, with small year-over-year increases. These larger units may be benefiting from families consolidating households or renters staying put longer due to the cost of moving. For investors, that could mean the higher-end multi-bedroom units might offer more rent resilience in certain areas, even as singles and couples downsize or pull back.

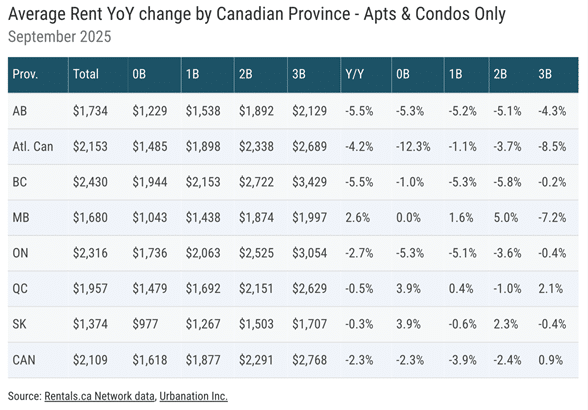

Provincial Rundown: BC and Alberta Cooling Fast, Ontario Still Soft, Quebec Holding

Across the provinces, the picture varies significantly. British Columbia and Alberta are experiencing some of the most noticeable declines, both showing 5.5% year-over-year drops in apartment and condo rents. In BC, that brings the average rent down to $2,430, and in Alberta, it’s now at $1,734. While still expensive by national standards, this signals a clear reset after the massive post-pandemic run-up in these provinces.

Ontario rents also slipped, but not quite as sharply. They’re down 2.7%, averaging $2,316 across apartment and condo units. Given the extreme price growth Ontario experienced over the last few years, this softening might feel modest—but it’s meaningful for investor returns, especially in cash-flow-tight markets like the GTA.

Quebec is showing surprising resilience, with a very slight 0.5% dip, holding strong around $1,957. In fact, over the last two years, Quebec’s rent growth has essentially plateaued, not crashed. That kind of stability in the face of national softening may offer some clues for investors looking to rebalance portfolios into more predictable regions.

Other notable points include Saskatchewan and Manitoba, both relatively steady performers. Saskatchewan posted only a 0.3% dip, while Manitoba actually saw a 2.6% increase, bringing its average rent to $1,680. Manitoba remains one of the few provinces bucking the downward trend in apartment rents.

Major City Trends: Vancouver, Calgary and Toronto Lead the Decline

When it comes to individual cities, the data confirms what many investors on the ground are already feeling. Vancouver saw the steepest rent decline among major metros, down 8.2% year-over-year to an average asking rent of $2,776. Over a two-year period, Vancouver’s rents are down nearly 17%, showing that high-cost cities may not be as rent-proof as they once seemed.

Calgary also recorded a 7.4% drop to $1,897, after several years of leading rent growth in Canada. This could be a temporary pullback, or it could indicate that some of the migration-fueled demand is starting to taper.

Toronto and the GTA saw a more moderate decrease—just 2.9%—but that still brings the average rent in the region to $2,592. That’s a significant number when you consider how stretched tenants already are in the GTA, and how crucial rental income is to investors carrying high mortgage costs.

Other large markets posted smaller drops. Ottawa is down 1.3%, now sitting at $2,190, while Montreal has only dipped 0.5% to $1,981. Edmonton saw a 2.3% drop to $1,573, marking its largest decline since the early pandemic days.

For investors watching rental comps or setting expectations for lease-up periods, these stats should be baked into pro formas, especially if you’re assuming aggressive growth post-renovation or BRRRR-style refinancing.

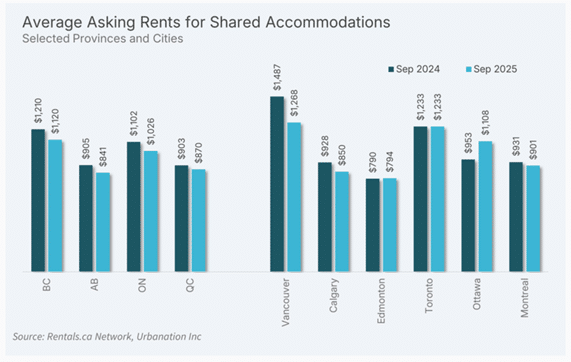

Shared Accommodations Are Sliding Too

It’s not just full-unit rentals feeling the slowdown. Shared accommodations—rooms for rent, co-living spaces, etc.—are also under pressure.

Across Canada, the average room rental is now $943, down 6.6% compared to last year. The steepest drops came from Vancouver (–14.7%) and Calgary (–8.4%). Toronto remained flat at $1,233, while Ottawa actually jumped 16.2%. That suggests strong demand for lower-cost housing options in the capital, while bigger cities may be seeing more tenants looking to exit shared housing in favour of affordable bachelor or one-bedroom units.

For investors with multi-room rental setups or co-living projects, this is worth watching closely. If tenant turnover increases or pricing expectations reset, vacancy periods could start stretching longer.

Final Thoughts: The Market Is Evolving — Not Crashing

While the national conversation around rent declines might trigger concern, the bigger picture is one of adjustment—not collapse. Rents aren’t plummeting, but they are correcting after a period of extended growth. In many cities, particularly high-demand ones like Toronto and Vancouver, rents are still elevated compared to five years ago—even if they’re off their 2024 highs.

What this means for investors is simple: you need to be sharper. Underwriting needs to account for flatter rent projections, not growth curves. Renovation projects should assume longer lease-up timelines. And financing decisions—especially for BRRRRs or refinances—should be based on conservative rent comps, not assumptions based on 2022–2023 heat. If there’s one upside here, it’s that markets like Manitoba, Quebec, and even select parts of Alberta are holding up relatively well. This isn’t a uniform shift. It’s localized. And that means opportunity still exists—it just requires a sharper lens.