There’s a big difference between growing your real estate portfolio and scaling your business. And if you’ve been in the game for any length of time, you’ve probably already experienced this.

At the beginning, things feel manageable. You buy your first property, maybe a second. You’re collecting rent, coordinating maintenance, keeping spreadsheets, checking in with your property manager, or maybe handling everything yourself. It’s a lot, but it works.

Then you add another property. And another. The systems you had in place—if you had any at all—start to feel stretched. That spreadsheet you used to track expenses suddenly needs to cover three different buildings in two different cities. You forget to follow up with the plumber. Lease renewals sneak up on you. Your once-tight operation starts to feel a bit… chaotic.

And that’s when it hits you: just buying more properties doesn’t mean you’re scaling.

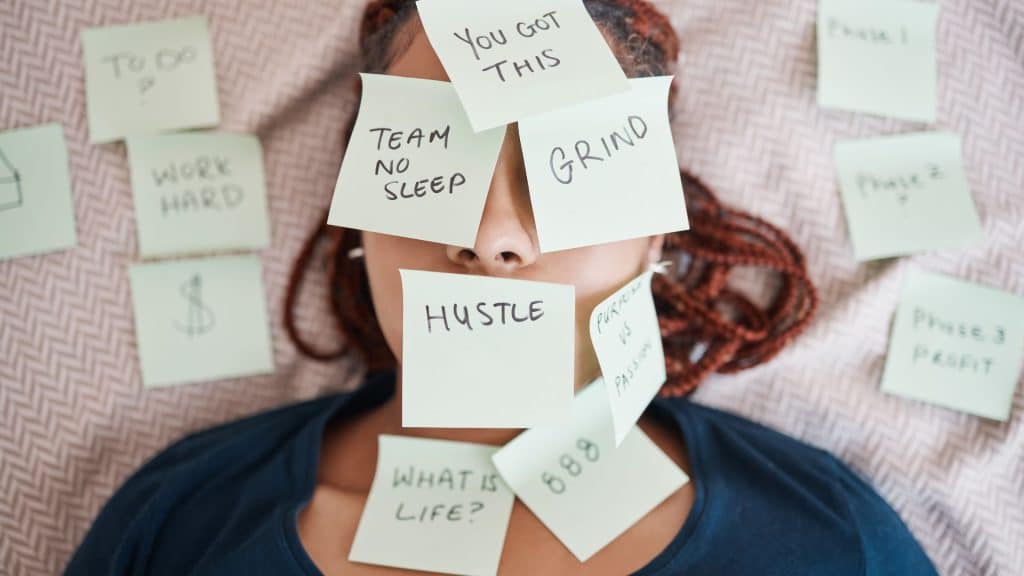

If anything, you might be setting yourself up to burn out.

Scaling isn’t about stacking properties. It’s about building a business that can grow without adding chaos, stress, or round-the-clock oversight. It’s about creating a structure where more properties actually lead to more freedom—not more fires to put out.

So what actually makes an investment—or more accurately, an investment model—scalable? Let’s break it down.

What Scalability Really Means in Real Estate

In basic terms, a scalable business is one where growth doesn’t require a matching increase in your personal time and energy.

If each property you buy adds another 5–10 hours a week to your workload, that’s not scale. That’s stacking. And it’s not sustainable.

True scalability means you can add properties, income, and complexity to your business without doubling your effort. It means having systems, team members, and processes that allow the business to grow even when you’re not personally involved in every single detail.

And most importantly—it means having clarity about what kind of portfolio you’re actually trying to build, and structuring your operations around that vision.

Not Every Property Is Built for Scale

Let’s be clear: not all real estate investments are scalable. Some deals can make money but create major drag on your time and energy. Others might be easy to manage but offer minimal returns. The key is understanding what kind of properties—and what kind of strategies—are truly built for long-term growth.

Take student rentals, for example. In many markets, they generate great cash flow. But they also tend to come with frequent turnover, high maintenance, and more day-to-day oversight. One student property might be fine. But managing five? That’s a full-time job unless you have rock-solid systems and people in place.

On the flip side, a well-managed fourplex with long-term tenants and professional property management might produce lower per-door income, but it’s consistent, predictable, and relatively hands-off. That’s the kind of investment you can replicate without adding hours to your calendar.

So when you’re evaluating deals, don’t just look at the return on paper. Ask yourself, “Can this model be repeated without stretching me thinner?” That’s the real measure of scalability.

Strategy First, Scale Second

One of the biggest mistakes investors make is trying to scale without a clear strategy.

It’s easy to get caught up in chasing deals—buying whatever looks like a “good opportunity” without considering how it fits into your overall business model. But that kind of reactive investing makes it almost impossible to scale. Instead, you end up with a mismatched portfolio that requires different management styles, different systems, and different financing structures—and you’re the one holding it all together.

Scaling starts with strategy. That means knowing exactly what kinds of properties you want to own, where you want to invest, what your ideal tenant profile looks like, and how each deal contributes to your long-term goals.

It also means being just as clear on what you won’t do. The clearer your investment criteria, the easier it becomes to make decisions—and the easier it is to build a repeatable, scalable model around it.

Systems Are the Backbone of Scale

No matter how smart or motivated you are, you can only go so far without proper systems in place. If you’re still collecting rent manually, organizing receipts in your email inbox, and tracking repairs through a series of text messages, you’re already behind.

Scalable businesses don’t run on memory—they run on systems.

Here are some of the foundational systems every scalable real estate business needs:

- Rent Collection: Use a dedicated platform that automates invoicing, tracks payment history, and reduces the need for manual follow-ups.

- Maintenance Requests: Set up a consistent process for receiving, documenting, assigning, and following up on repairs—ideally one that doesn’t involve tenants texting you at 10 p.m.

- Bookkeeping & Expense Tracking: Use software (or a solid spreadsheet system at the very least) that keeps your finances clean and easy to review—especially come tax time.

- Tenant Communications: Have a plan for how, when, and where tenant updates are shared—especially for renewals, notices, and rule enforcement.

- Deal Analysis: Develop a standardized approach to evaluating new opportunities, so you’re not reinventing the wheel with every potential deal.

- JV & Investor Reporting: If you’re raising capital or managing partners, you’ll need templates and routines for updating them regularly, tracking performance, and maintaining trust.

The goal here isn’t to become a robot—it’s to remove the friction that slows you down and creates unnecessary stress. When you’ve got systems that work, adding another property doesn’t feel like starting from scratch.

Your Team Will Make or Break Your Ability to Grow

Scaling without a strong team is like building a house without a foundation. It might look good for a while, but it won’t hold.

If every decision, every problem, every late-night call depends on you, you’re going to hit a ceiling fast. The most successful investors aren’t just dealmakers—they’re team builders. They know how to surround themselves with professionals who support their goals and take responsibility for their roles.

That means having a realtor who brings you the right kind of deals, a mortgage broker who understands investor financing, a contractor who actually shows up, a property manager who doesn’t need to be babysat, and a lawyer and accountant who specialize in real estate structures.

Your job isn’t to do it all—it’s to build the structure where other people can help you do more, better.

Capital Is Part of the Equation—But Not the Whole Story

It goes without saying that you can’t scale without access to capital. But having money doesn’t make you scalable. Knowing how to use capital strategically does.

That includes understanding when to use your own funds, when to bring in a partner, how to structure JV agreements that support growth (not limit it), and how to maintain lender confidence as your portfolio expands.

Scaling isn’t about how much money you have—it’s about how many options you’ve created for accessing it. Smart investors aren’t just raising capital; they’re building repeatable systems for attracting, structuring, and managing it responsibly.

You Might Be the Bottleneck

This one’s tough, but it’s true: sometimes the reason your business isn’t scaling is because of you.

If you’re the only one who can underwrite a deal, approve a repair, make decisions, manage the property, talk to the lender, file the taxes, and talk to tenants—you’re the ceiling.

And if your portfolio depends on you being available 24/7, you don’t own a business. You own a job.

Scaling requires stepping back and asking, “What part of this can I delegate, automate, or remove entirely?” That doesn’t mean disappearing—it means setting your business up so it can function without you being the sole point of failure.

Bigger Isn’t Always Better—Smarter Is

Let’s be clear: not everyone needs—or wants—a huge portfolio. If your goal is to own five doors that cash flow well, support your lifestyle, and leave you plenty of time for family or travel, that’s a win. You don’t need to scale to 50 units just because someone else did.

But if your goal is to grow, to build a portfolio that can support your goals and eventually run without your full-time involvement, then you need to start thinking like a business owner—not just an investor.

Scaling isn’t about doing more. It’s about doing what works, better.

Final Thought

So, what actually makes an investment scalable?

It’s not just the property type. It’s not just the market. And it’s not just how much money it makes.

Scalability is about structure. It’s about knowing your model, building your systems, trusting your team, and creating a business that’s designed to grow—without depending on you working harder every time.

If you’re feeling stuck in your portfolio, it might be time to stop looking for the next deal… and start looking at how your business actually runs.

Because when you fix the foundation, growth becomes a whole lot easier to manage.

If you’re ready to build something that doesn’t just grow—but lasts—come check out Savvy Squad. Weekly training, tools, support, and strategy sessions with real investors who’ve been where you are. You don’t have to build this alone.